Chidambaram heads Japan to sell India as budget proposals have to be implemented next morning without any opposition whatsoever. Fundamentals of economy have not changed as yet neither fiscal policies revisited and the government focuses on only monetary exercise!

Palash Biswas

Mobile: 919903717833

Skype ID: palash.biswas4

Email: palashbiswaskl@gmail.com

India's current account deficit — the gap between the inflow and outflow of foreign currencies — soared to a record 6.7% of gross domestic product during October-December from 5.4% in the previous quarter.But without addressing the crisis at home front,Finance minister P Chidambaram is heading to Japan for three days, after his visits to Hong Kong, Singapore besides several countries in Europe, to sell India as the top investment destination at a time when the country's current account deficit has hit an alarming 6.7% for the third quarter.On the other hand, budget proposals have to be implemented next morning without any opposition whatsoever. Fundamentals of eonomy have not changed as yet neither fical policies revisited and the government focuses on only monetary exercise!The exclusive economy sustained and reforms pushed further to ensure blackmoney recycle.People of india have no respite!The government has allowed FDI in multi-brand retail, power exchanges and hiked FDI cap in single-brand retail and broadcasting.In the first 10 months of current financial year, foreign direct investment (FDI) contracted by 33 per cent to USD 21 billion against USD 31 billion in the same period last year due to the global economic uncertainties.

www.dnaindia.com › MONEY

Feb 28, 2013 – P Chidambaram presented his 8th Union Budget and India's 82nd. Read the full text of his speech:

indiatoday.intoday.in › Business › Budget

Feb 28, 2013 – The Finance Minister began his speech by seeking the support of all stakeholders in helping navigate the Indian economy through the current ...

indiabudget.nic.in/

Union Budget 2013-2014 · Key to Budget Documents PDF File Opens in a new window... Hon'ble Finance Minister Presented Union Budget in the Parliament ...

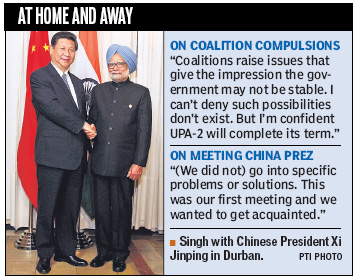

he possibility of Mulayam Singh Yadav's Samajwadi Party withdrawing support to his government does exist, Prime Minister Manmohan Singh acknowledged obliquely, even as he expressed confidence that UPA-2 would complete its full term.

Prime Minister Manmohan Singh addressing an onboard press conference during his return journey after concluding the fifth BRICS Summit in Durban, South Africa, in the VVIP flight. NSA Shiv Shanker Menon is also seen. PTI Photo

Singh also said uncertainties arising out of coalition politics notwithstanding, his government would push ahead with reform measures in the coming months. "We will not allow reforms to be derailed," he said Thursday.

He was interacting with journalists accompanying him back from Durban in South Africa, where he attended the two-day Brics (Brazil, Russia, India China and South Africa) summit.

related story

Asked if he feared the SP pulling the plug on the government, given all the signs from Yadav recently, Singh said: "Coalitions raise issues that give the impression the government may not be stable. I cannot deny that such possibilities don't exist. But I am confident our government will complete its full term and the next election will take place as scheduled in 2014."

With the DMK's exit, the UPA is entirely dependent on the SP and the BSP, which provide outside support with 22 and 21 Lok Sabha MPs, respectively. While the BSP is expected to favour a late elections, the SP is possibly weighing its options on how long to continue with the government.

On whether the increasing political vulnerability of his government has slowed down the reform measures he launched last year, Singh said: "We don't have the majority and are certainly dependent on the goodwill of our allies. I can't deny there are uncertainties." However, he said "reforms that matter" and are expected to create good results in the next few months would not stop.

Asked if the UPA was being deserted by its allies one after another due to the inability of the Congress and his own leadership, he shot back, "Although we have compulsions, we will not allow them to derail reforms. We will not allow a situation where the essential task of governance of our country is compromised."

On one-time ally Mamata Banerjee's offer of support to the government on matters of foreign policy, Singh said all right-thinking individuals and parties must support the government's initiatives.

Curiously, Singh did not rule himself out of the race for a third term in office, in the wake of Rahul Gandhi's statement that becoming PM was not his priority. Asked if he would be game if the Congress leadership proposed his name, he evaded a direct reply. "That is a hypothetical question. We will cross the bridge when we reach there."

PM had in a recent speech in Parliament said the BJP's dream of coming to power in 2014 would not be fulfilled, adding: "There will be a UPA-3."

He refused to comment on the matter of the Italian marines facing trial for killing two Indian fishermen, only saying: "It will be presumptuous on my part to comment on judicial proceedings."

http://www.hindustantimes.com/India-news/NewDelhi/Allies-may-ditch-us-but-we-won-t-ditch-reforms-PM/Article1-1033892.aspx

Finance Ministry already declared that there is a scope for easing of monetary policy to boost growth in view of moderation in WPI-based inflation.

"Inflation numbers have also come down so there is certainly a case for (giving) further impulses for growth," DEA Secretary Arvind Mayaram told reporters here.

Asked if the RBI will cut rates in its upcoming policy review, he said the central bank will definitely factor into account various developments and make an assessment of the macro economic conditions.

RBI is scheduled to announce its mid-quarter review of monetary policy on March 19 and there is a widespread expectation that it will cut policy rates to boost growth.

ndia's current account deficit (CAD) touched a record high of 6.7% of GDP in the October-December quarter, mainly on account of widening trade gap.

The CAD, which is the difference between inflow and outflow of foreign currency, "widened from 5.4% in Q2 (July-September) to a record high of 6.7% of GDP in Q3, driven mainly by large trade deficit", Reserve Bank of India said in its report on Balance of Payments.

The report said while the merchandise exports did not show any significant growth during the third quarter ending December 2012, the imports shot up by 9.4%, spurred largely by oil and gold imports.

The trade deficit, the RBI said, widened to $59.6 billion in third quarter, up from $48.6 billion in the corresponding quarter a year ago.

Finance minister P Chidambaram in his budget speech had said: "my greater worry is the CAD". He attributed the rise in the CAD to factors like excessive dependence on oil imports, the high volume of coal imports, passion for gold and slowdown in exports.

During April-December 2012, CAD stood at $71.7 billion accounting for 5.4% of GDP as against $56.5 billion (4.1% of GDP) in the same period of 2011.

According to RBI report, CAD in the Q3 rose by over 61% to $32.6 billion, from $20.2 billion in the corresponding quarter last fiscal.

The central bank said the surge in capital inflows, mainly on account of portfolio investment, would help in financing the higher CAD.

The FII inflow during the quarter rose to $8.6 billion from $1.8 billion a year ago.

The Finance minister, with senior officials of the ministry including economic affairs secretary Arvind Mayaram and chief economic advisor Raghuram Rajan in tow, is slated to meet his Japanese counterpart, and other investors.

Chidambaram is expected to outline measures to kick start the investment cycle, which would boost the industry and services sectors — critical for reviving growth and job creation.

"The government would go ahead with the reform process while taking all other steps to ensure that investments start trickling in and the finance minister's effort would be to invite investors," a senior finance ministry official, who did not wish to be identified, said. Investments have been slow in the last few months, while the infrastructure sector alone requires $1 trillion during the 12th plan (2012-17).

Chidambaram would also highlight the steps that his government has already taken to boost growth.

Earlier, Rajan had underlined the need to increase of foreign and domestic investment to help in financing the yawning current account deficit besides improving the environment to boost exports.

The sixth edition of the consolidated FDI policy will be released by the Department of Industrial Policy and Promotion (DIPP) this week which will incorporate the changes made in the regulations over the past one year, an official has said.The DIPP is the nodal agency on FDI related matters. With a view to make India's FDI regime simple and easy to understand for investors, the department had compiled all the related policies into a single document.Foreign direct investment (FDI) is considered crucial for economic development of a country and India has taken several steps to attract such funds.

Meanwhile,Finance minister P Chidambaram announced a string of steps to attract more foreign funds. And by obliquely hinting that more measures were likely soon, he triggered speculation about the next phase of reforms. Speaking at the Economic Editors' Conference in New Delhi,

Chidambaram did not specify the moves the government was "steadily and surely" working on, but there are expectations that the FDI policy may be reviewed to ease the caps fixed for different sectors.The announcements followed the DMK's decision to pull out of the government, giving rise to uncertainties over the reforms ahead of the next elections.

First, Chidambaram assured that one of the most important reforms measures, the food security bill, "will be passed soon, possibly in the budget session itself".

The finance minister also made it easier for FIIs to invest in corporate and government bond markets. The move aims at narrowing the current account deficit — the difference between dollar earnings and payments — that has hit a record high of 5.4% of GDP.

He said, "From April 1, there will be two baskets (for FIIs to invest), one of $25 billion for government securities and (the other) of $51 billion for all corporate bonds" to help FIIs plan their India investment portfolio in a less-complicated manner.

While most of these moves will not require legislative sanction, investors are waiting for cues on politically contentious issues.

The Cabinet Committee on Investments, which was set up in January for clearing major infrastructure projects, is expected to give its nod for a number of projects within the next three weeks, planning commission deputy chairman Montek Singh Ahluwalia has said.Giving a major push to infrastructure and energy sector, the government in the past two months has given nod to projects worth Rs. 74,000 crore which were stuck for years due to lack of various clearances.

"My hope is that the Cabinet Committee on Investment in the course of next 2 to 3 weeks, will demonstrate that a number of (infrastructure) projects can get cleared," he told a seminar organised by SICCI in Chennai.

The Committee had met two or three times already, he said.

His comments come close on the heels of the CCI in its first decision on March 20 clearing Reliance Industries' producing KG-D6 block and gas discovery area NEC-25.

This was along with three other areas where the Defence Ministry had either barred oil and gas activity or put stringent conditions on it.

Besides, the Environment and Forests Ministry had also informed CCI that it had initiated steps for speedy approval to infrastructure projects, stuck for want of green nod.

Talking about energy prices, Ahluwalia favoured aligning domestic energy prices with global energy prices.

"Domestic energy prices have to be more closely aligned to global prices. Very few of my political colleagues would find it easy to pursuade their audiences. I have addressed group of MPs trying to make this point that in a world in which energyis expensive, you will be shooting yourself in the foot, by trying to keep energy cheap at home," he said.He said the government had taken a bold step by increasing diesel prices by around 50 paise every month, with a goal to eliminate under pricing of diesel over an 18-month period.

Pitching for a "political consensus" on aligning domestic energy prices with international prices, he said, "if you get that, it would probably be the best things for the Indian economy, in terms of growth potential".

Ahluwalia also said current account deficit remaining high was a matter of great concern. "We need to move over the next two to three years, in a concerted way, in reducing the fiscal deficit, getting rid of supply constraints and solving the regulatory problems with infrastructure projects."

"Most of all, solving the fuel supply problems for the power sector and all this put together will enable the Indian economy to see increase in investments," he said.

During the next financial year that is about to begin soon, the emphasis would be "to simply make sure that (India's) infrastructure story, looks very good", he said.

Noting that India should have more projects on power generation, he said such an expansion has been mainly done by the private sector.

"We have been very successful in expanding the space in power sector. In 10th plan, we added 21,000 MW. In 11th plan which ended in 2011-12, we added 54,000 MW. In the last year of the plan, we added 22,000 MW which is a little more than the whole of what was done in the 10th Plan," he said.

As cooking gas policy changes, RIL smells opportunity

The domestic cooking gas (LPG) retailing market, which is dominated by the three state-owned oil companies, may soon see a private-sector competitor: Reliance Industries Ltd (RIL), controlled by billionaire Mukesh Ambani, is said to be mulling a foray into the segment. Sources close to the company told HT that the nine-cylinders-a-year cap on subsidised LPG cylinders has opened a lucrative window for private energy companies supply non-subsidised cooking gas (beyond 9 cylinders) to domestic households.The company spokesperson refused comment, but sources said "the company will look at all possibilities that make sense for its business growth."Hindustan Times reports.

RIL is already doing a test run of markets in Gujarat and Maharashtra, supplying small quantities of auto and industrial LPG. Company sources said it may look at these two states to begin cooking gas operations, as all-India operations call for a big infrastructure and dealership network.

"The entry of private players in the non-subsidised LPG segment can actually generate a price competition among suppliers to the benefit of consumers, bringing down the price," said a senior petroleum ministry official.

After the new cap was imposed, households consuming more the nine cylinders a year have to pay market price of about Rs. 900 for the 14.2-kg cylinder as against Rs. 410 for the subsidised cylinder (in Delhi).

If a private player engages in selling unsubsidised gas, it can offer cylinders at a discount to the international market prices in order to garner market share.

FDI in defence sector would be an effective catalyst for self-reliance

VINAY KUMAR

BAE Systems, a defence, aerospace and security company, employs 93,500 people worldwide. Its wide-ranging products and services cover air, land and naval forces, as well as advanced electronics, security, information technology, and support services.

With a presence that goes back over 60 years, BAE Systems has developed India as a home market with a strategic vision to become a major and integral part of the domestic Indian defence and security industry, leveraging its global expertise to develop technologies and solutions in India for both the Indian market and for export.

It has a joint venture in India with Hindustan Aeronautics – BaeHA. Based in Bangalore, it is focused on providing engineering and business solutions services. BAE Systems has a long-standing association with HAL on aircraft programmes such as Jaguar, Harrier, and now, the Hawk Advanced Jet Trainer which HAL manufactures under licence for the Indian Air Force and Navy.

The board of BAE Systems, led by its global chairman Dick Olver, visited India for the first time. In this e-mail interview to The Hindu, he outlines the company's plans for India.

What is the Board's overall impression of the market in India?

BAE Systems has a long association with India in many areas of aerospace and defence, with all three of the Indian Armed services — dating back to pre-independence times. I have personally had an opportunity to visit India many times — most recently in February as part of Prime Minister Cameron's delegation. And, I am thrilled to lead the visit of the BAE Systems plc Board here this week. India is an incredible country. It is a key market for our company. So, I was keen that my fellow directors had the opportunity to see and experience that first hand. We have a solid team here, who are privileged to work with some exceptional people across the customer community and through our relationships with Indian companies. The Board has been impressed with what we have seen and experienced during our visit.

The Indian market holds considerable opportunities for us, and I and the other directors are very excited and energised by the potential that exists here, illustrated by the steady trend in defence expenditure at around 2 per cent of GDP, a stated intent of $100 billion worth of acquisitions over the next five years, and the focus on self-reliance in defence.

A personal highlight was the launch of the mobile mini hospital called 'Smile on Wheels' that will provide primary healthcare services to underserved communities in Bangalore. The mini hospital is part of the company's corporate social responsibility programme in India through which we support development programmes in the areas of primary education and healthcare in rural and urban communities across seven states of India. .

BAE has had a longstanding association with HAL on the India Hawk and even has a JV with the aerospace major. How do you view the future of the relationship?

Our relationship with HAL for the Indian Hawk programme is the cornerstone of our operations in India today. We are privileged to enjoy a strong relationship with HAL, and our latest collaboration is for the licence to build Hawk Advanced Jet Trainer. India has ordered a quantity of 123 aircraft with another 20 in negotiation.

Having the experience of working together to create advanced fast jets built in India, both HAL and BAE Systems would like to progress the relationship and broaden the collaboration between our respective organisations. We also have an engineering services and business solutions joint venture with HAL called BAeHAL. Although relatively small in size, we believe this is strategically important, and both partners have ambitions to grow the JV over time.

Building domestic capabilities in partnership with Indian companies will remain a cornerstone of our strategy in India.

BAE Systems has been an advocate for the relaxation of the FDI rules in defence. But it hasn't happened so far. Recently Raghuram Rajan, Chief Economic Advisor to the Government, has suggested liberalisation of FDI norms in the sector. Does that make you hopeful that the voice of companies such as yours will be heard soon?

I have noted that there has been increased emphasis in recent weeks in India on the growing importance of more rapid indigenisation of the defence sector. In addition to the economic benefits, increased jobs, improved capability and the development of critical technology , indigenisation would ensure India has ready access to the best available defence equipment.

In support of that objective, in my view, an appropriate increase in FDI in the defence sector would be the most effective catalyst for self-reliance, and, for that reason, I am hopeful that liberalisation in FDI will occur. We understand and respect the Government's position, and we are here for the long-term regardless of changes in FDI to fully support a more rapid development of a vibrant, indigenous defence sector in this country.

What should India be doing to develop a strong domestic aerospace and defence industry?

The FDI issue we just discussed is obviously a part of that equation. I also think international companies need to be cognizant of and able to address the complexities of technology transfer, and we need the Indian industrial base to work with us on this.

I am also a strong believer in the importance of education and the investment that is needed in order to sustain a country's ability to grow and remain competitive. For India, this is a fascinating opportunity and challenge given its young population and its fast-growing economy.

A strong domestic aerospace and defence industry needs to be underpinned by world-class productivity and powered by high-value engineering skills and education. To do this, you need the right skills in the right places at the right time and in the right quantities.

Getting all that right is not easy. But when you do, the effect is electrifying. Look at Silicon Valley in the U.S. or the U.K.'s high-tech and biotech cluster around Cambridge. Closer to home, the Indian IT services sector is a world-class example of skill development, training and education coming together to provide competitive advantage to the country.

How does the Indian market compare to other markets for BAE Systems? What are your expectations from India in the next 5-8 years?

India's ambitious plans for modernisation, expansion and indigenisation are the market's core drivers, setting it apart from the mature markets, where budgets are either flat or declining. However, this is a market which requires a long-term perspective. We have set ourselves a target one billion pound of order intake across 2012 and 2013, and are making good progress on this.

Our long term vision for our business in India is to be an integral part of the country's defence, aerospace and security industry by supporting the country's goal of creating a domestic industrial base.

vinay.k@thehindu.co.in

http://www.thehindu.com/business/Industry/fdi-in-defence-sector-would-be-an-effective-catalyst-for-selfreliance/article4562244.ece?homepage=true

Financial sector reforms : Progress on FDI, Companies Bill Mar 26 2013, 21:57 | By Moneycontrol.com |

* * Arnav Pandya The financial sector is a critical component of the Indian economy. Effective reforms are required to ensure that this remains competitive and attractive for investors from across the world. There is also a significant fallout from the steps that are taken in this area so the kind of reforms that are undertaken also remain a significant factor to consider. Here is a look at some of the recent reforms in the area along with the impact that would be seen sometime down the line which in several cases could turn out to be more like years instead of months. One measure that has received a lot of attention is the attempt at raising the Foreign Direct Investment (FDI) cap in the insurance and pension sector. This will lead to foreign players being able to acquire a larger share in their joint ventures that are already operating in the country. The biggest impact of this move is that it will open the route for additional capital infusion in the companies that are operating in these sectors which is something that is required as it will ease the financial crunch that they face. The other impact will be seen over the longer term as a higher share by the foreign entity will lead to the introduction of several best practises seen across the world. The investors will also be able to access world class products that will make their way to the country which will enable them to save for their future goals in an effective manner. The revised Companies Bill is now just a small step away from being law. There is a need for the various conditions that govern action of companies and their mode of operation to remain in tune with the changing environment. The new Companies bill will fill this role effectively because it will enable companies to carry on their processes in a simple and easy manner. This will ensure that their practises are in tune with what is being witnessed across the world. There are already large scale changes in the way in which companies operate and even deal with their investors so the introduction of postal ballot followed by e voting along with the sending of notices and all intimations by email has ensured that these changes are being visible in the day to day dealings. The biggest change that will however be seen by individuals in the future is through various changes to the banking sector. One of the initial steps has been taken in the form of allowing new banks to set up shop. Private corporates, public sector entities and Non Banking Finance Companies with a strong track record can now apply to set up new banks and the Reserve bank of India will consider these applications in the coming months. The addition of new banks will mean more competition for this sector in the country and it will lead to an improvement in services for the end customer. It is expected to increase financial inclusion as more and more people across the country will be able to access banking facilities. In reforms for the existing banks the public sector banks have been allowed to increase or decrease the authorised capital without the presence of an overall ceiling. This will give greater flexibility to the banks to conduct their fund raising activities as per the requirements. The strict restriction of voting rights in banks will also be relaxed and this will help the banking sector develop as large investors will be able to get a bigger voice in the coming days in the banks and the manner in which they operate. (The writer is a certified financial planner) |

http://www.moneycontrol.com/smementor/news/finance-capital/financial-sector-reforms-progressfdi-companies-bill-843452.html

Current account deficit may hit record high of 6.4% in Q3 Mar 30 2013, 16:26 | By Moneycontrol.com |

* * Related

Moneycontrol Bureau India's current account deficit (CAD) for the quarter ended December is expected to come at an all time high of 6.4 percent against 5.4 percent in the July-Sept period, a CNBC-TV18 poll showed. The Reserve Bank of India will announce CAD number for third quarter at 5 pm today. The aggregate CAD is expected to rise to USD 31 billion from USD 22.4 billion a quarter ago and USD 16.5 billion a year ago. The finance minister has repeatedly shown concerns over the widening current account deficit and had also taken measures like raising gold import duty to rein in the ever-increasing crevasse. In his Budget speech finance minister P.Chidambaram noted, "CAD continues to be high mainly because of our excessive dependence on oil imports, the high volume of coal imports, our passion for gold, and the slowdown in exports. This year, and perhaps next year too, we have to find over $75 billion to finance the CAD." Also Read: CAD will improve from Q4; TCS better than Infosys: Kotak High CAD increases our dependence on foreign funds, which is not a good sign in the current volatile global environment. In a time when the government's priority is to revive economic growth, high CAD can be a huge deterrent as it does not allow the central bank to take pro-growth initiatives In its recent monetary policy review, Reserve Bank of India had stated that high current account deficit gave a limited scope for cutting key rates. However, there have been some signs of improvement in this situation. India's exports recorded a growth of 4.2 per cent on a YoY basis in February 2013. It is the first time since February last year that export grew at this pace. In its recent report credit rating agency CRISIL noted, "India's merchandise exports may recover further in 2013 due to an improved global economic outlook and government's efforts to support exports. The FM in his budget speech stated that very soon a new trade policy will be announced to boost exports. On the other hand, lower crude oil prices coupled with the deregulation of diesel prices is likely to keep the oil import bill under check." Prime Minister's Economic Advisory Council (PMEAC) Chairman C Rangarajan believes that CAD is likely to come down in the fourth quarter of the current fiscal, ending March 31, on the back of improvement in exports in the last few months. "Perhaps the third quarter current account deficit will be higher but it could come down in the fourth quarter. Because exports have shown some sign of improvement in the last few months," he told reporters at a recent event. Also improving capital inflows are likely to support high deficit. A CNBC-TV18 poll expects Foreign Institutional Investment to grow to USD 7 billion up from USD 1.8 billion year ago. Pro-reform announcement post September have improved foreign investment in the country. As some other measures, the government may cut withholding tax on rupee-denominated debt to percent after reducing the tax on foreign borrowings to 5 percent from 20 percent, CNBC-TV18 had earlier reported. |

http://www.moneycontrol.com/smementor/news/indian-markets/current-account-deficit-may-hit-record-high64q3-843807.html

Budget 2013-14: Highlights

PTIUnion Finance Minister P. Chidambaram presents Budget 2013-14 in the Lok Sabha

Tax credit of Rs. 2,000 for income upto Rs. 5 lakh; Surcharge of 10 per cent for taxable incomes above Rs. 1 crore, No review of tax slabs; Commodity transaction tax for non-agri commodity trading; Tax Deducted at Source to be fixed at 1% on land deals over Rs 50 lakh; 30% excise duty hike on SUVs; 6% excise duty hike on mobiles above Rs. 2,000

Tax credit of Rs. 2,000 for income upto Rs. 5 lakh

Surcharge of 10 per cent for taxable incomes above Rs. 1 crore, No review of tax slabs

Excise duty on SUVs to be increased to 30 per cent from 27 per cent, SUVs registered as taxis exempted

Commodities transaction tax levied on non—agriculture commodities futures contracts at 0.01 per cent

Rs 532 crore to make post offices part of core banking

Direct Taxes Code (DTC) bill to be introduced in current Parliament session

Duty-free limits raised to Rs 50000 for men and Rs 1 lakh for women

18% rise in excise duty on Cigarattes, cigars and cheerots

Service tax on all A/C restaurants

Royalty tax hiked from 10% to 25%

Tax Deducted at Source to be fixed at 1% on land deals over Rs 50 lakh

No change in peak custom, excise rates.

5 to 10 per cent surcharge on domestic companies whose taxable income exceeds Rs 10 crore

11 lakh beneficiaries have received benefit under Direct Benefit Transfer scheme. Direct Benefit Transfer (DBT) Scheme to be rolled out throughout the country during the term of UPA Government.

Modified GAAR norms to be introduced from April 1, 2016.

Administration reform commission proposed

Rs 5,87,082 crore to be transferred to states under share of taxes and non plan grants in 2013—14

"To the women of India - we have a collective responsibility to ensure the dignity and safety of women. Recent incidents have cast a long dark shadow on our credentials. As more women enter public spaces...there are more reports of violence against them. We stand in solidarity with our girl children. We pledge to everything possible to keep them swcure. A number of measures are in the works and they will be taken up Government and Non-government sources…I will set up a fund of Rs 1000 crore to achieve this end. Minstry of Women will come up with a plan on how to use these funds."

Rs. 1,000 crore each for women, youth funds

Rs. 1,000 crore for Nirbhaya fund

Promise to women, youth and senior citizens

289 more cities to get private radio FM stations

Grant of Rs 100 crore each to AMU (Aligarh), BHU (Varanasi) and TISS (Guwahati) and INTACH

"Rs 6275 crore to Ministry of Technology, Rs 5216 crore to Department of Space, Rs 5280 crore to Department of Energy. These amounts are substantial increases."

Rs. 2 trillion for defence sector

First home loan from a bank or housing finance corporation upto Rs. 25 lakh entitled to additional deduction of interest upto Rs. 1 lakh.

Proposal to launch Inflation Indexed Bonds or Inflation Indexed National Security Certificates to protect savings from inflation.

On oil and gas exploration policy, the Budget proposes to move from the present profit sharing mechanism to revenue sharing. Natural gas pricing policy will be reviewed.

Insurance companies can now open branches in Tier 2 cities and below without prior approval. All towns of India with a population of 10000 or more will have an LIC branch and one other public sector insurance company.

Income limit for the tax-saving Rajiv Gandhi Equity Savings Scheme is raised to Rs. 12 lakh from Rs. 10 lakh

All public-sector banks have assured the Finance Minister that they will all have ATMs in their branch areas by 2014

India's first women's bank as a PSU proposed, Rs. 1,000 crore working capital announced

India Infrastructure Finance Corporation (IIFC), in partnership with ADB will help infrastructure companies to access bond market to tap long term funds.

Regulatory authority to be set up for road sector

Four Infrastructure debt funds have been registered

Rs 7 lakh crore target fixed for agri credit for 2013—14 compared to Rs 5.75 lakh crore in the current year.

Eastern Indian states to get Rs 1,000 crore allocation for improving agricultural production.

Green revolution in east India significant. Rice output increased in Assam, Odisha, Jharkhand and West Bengal;

Rs 500 crore allocated for programme on crop diversification

ICDS gets Rs. 17,700 crore.

Average annual growth rate of agriculture and allied services estimated at 3.6 per cent in 2012—13 when 250 MT foodgrains was produced

Rs 27,049 crore allocation to the Agriculture Ministry in 2013—14

The target for farm credit for 2013-14 has been set at Rs. 7,00,000 crore against Rs. 5,75,000 crore during the current year.

Rs 14,873 crore for JNNURM for urban transportation in 2013—14 against Rs 7,880 crore in the current fiscal

Foodgrain production in 2012—13 will be over 250 million tons

Rs 15,260 crore to be allocated to Ministry of Drinking Water and Sanitation.

Rs 80,194 crore allocation for Ministry of Rural Development in 2013—14. About Rs 33,000 crore for MGNREGA

Rs. 5,000 crore for NABARD for agri storage facilities

Godowns to be constructed with help of panchayats. Food grain productions have been raised drastically and only increase with each year.

Rs 17,700 crore to be allocated for Integrated Child Development Scheme (ICDS): FM.

"National Food security bill is a promise of the UPA government. I hope the bill be passed as soon as possible. I have set apart Rs 10,000 crore to the expected cost of the act."

An Institute for agricultural biotechnology will be set up in Ranchi, Jharkhand.

Rs 1069 crore allocated to Department of Aryush: FM

Rs 4,727 crore to be allocated for medical education and research. Rs 1,069 crore to be given to Department of Ayush.

Medical colleges in six more AIIMS—like institutions to start functioning this year; Rs 1650 crore allocated for the purpose.

Rs 37,330 crore allocated for Ministry of Health & Family Welfare.

Rs 110 crore to be allocated to the department of disability affairs, says FM.

Additional sum of Rs 200 crore to Women and Child Welfare Ministry to address issues of vulnerable women.

Rs 3511 crore allocated to Minority Affairs Ministry which is 60 per cent of the revised estimates.

Rs 13215 crore for mid-day meal programme: Chidambaram

The idea of setting up a PNGSY-2 causes uproar in the Parliament. The minister is interrupted the round of shouting, who clarifies that states that have completed PNGSY -1 will get the second version, the rest will continue under the first version

The Right to Education Act is firmly in place, says Chidambaram, while announcing Rs. 27,250 crore to Sarva Shikhsa Abhiyaan in FY14.

The Human Resources Development ministry meanwhile gets Rs. 65,867 crore, a rise of 17% from revised estimates.

"Government committed to reconstruction of Nalanda University" - But no specific funds for the project was announced.

Chidambaram announces additional fund allocation of Rs 200 crore to the Women and Child Development Ministry. He says women 'belonging to the most vulnerable groups must be able to live with self-esteem and dignity'.

169 crore given for development of Ayurveda, Siddha, Unani (Natural medicine) and homeopathy

Rs 41,561 crore for SC plan and Rs 24,598 crore for tribal plan. The move comes with a strong statement

Plan Expenditure placed at Rs. 5,55,322 crore. It is 33.3 percent of the total expenditure while Non Plan Expenditure is estimated at Rs. 11,09,975 crore. The plan expenditure in 2013-14 will be 29.4 percent more than the RE of the year 2012-13.

Fiscal Deficit for 2013-14 is pegged at 4.8 percent of GDP. The Revenue Deficit will be 3.3 percent for the same period.

On oil and gas exploration policy, the Budget proposes to move from the present profit sharing mechanism to revenue sharing. Natural gas pricing policy will be reviewed.

On coal, the Budget proposes adoption of a policy of pooled pricing.

Benefits or preferences enjoyed by MSME to continue upto three years after they grow out of this category.

Refinancing capacity of SIDBI raised to Rs. 10,000 crore.

Technology Upgradation Fund Scheme (TUFS) for textile to continue in 12th Plan with an investment target of Rs. 1,51,000 crore.

Rs. 14,000 crore will be provided to public sector banks for capital infusion in 2013-14.

A grant of Rs. 100 crore each has been made to 4 institutions of excellence including Aligarh Muslim University, Banaras Hindu University, Tata Institute of Social Sciences, Guwahati and Indian National Trust for Art and Cultural Heritage (INTACH).

A surcharge of 10 pe rcent on persons (other than companies) whose taxable income exceeds Rs.1 crore have been levied.

Generation based incentives to wind energy projects reintroduced, Rs 800 crore provided for the purpose to Ministry of New & Renewable Energy

Rs 14,000 crore capital infusion into public sector banks in 2013—14

Standing Council of Experts in Ministry of Finance to examine transaction cost of doing business in India

Financial Sector Legislative Reforms Commission (FSLRC) to submit its report next month

Incubators set up by companies in academic institutions will qualify for Corporate Social Responsibility (CSR) activities

Rs 500 crore would be allocated for addressing environmental issues faced by textile industry

Concessional six per cent interest on loans to weavers.

SEBI will simplify procedures for entry of foreign portfolio investors

SIDBI's re—financing facility to MSMEs to be doubled to Rs 10,000 crore

5 million tons Dabhol LNG import terminal to be operated at full capacity in 2013—14

Coal imports during Apr—Dec 2012 crossed 100 million tonnes and expected to go up to 185 million tonnes in 2016—17,

Government will provide Rs 14000-crore capital infusion in state-run (public-sector) banks in 2013/14

Oil and gas exploration policy will be reviewed and moved from profit sharing to revenue sharing

Policy on exploration of shale gas on the anvil; natural gas pricing policy will be reviewed and uncertainty removed

Rs. 9,000 crore earmarked as the first installment of balance of CST compensations to different States/UTs.

Govt to construct power transmission system from Srinagar to Leh at the cost of Rs 1,840 crore, Rs 226 crore provided

Rs 2400 crore for textile technology upgradation

Two new ports in West Bengal and Andhra Pradesh

Many manufacturing projects stalled due to regulatory process

A company investing Rs 100 crore or more in plant and machinery in April 1, 2013 to March 31, 2015 will be allowed 15 per cent investment deduction allowance apart from depreciation

To provide appropriate incentives for semiconductors industry including zero customs duty on plants and machineries.

Fresh push for Bangalore-Chennai industrial corridor. Minister says the corridor to be developed in co-operation with the Japanese.

DIPP and Japan's JICA preparing plan for Chennai— Bengaluru Industrial corridor

Power sector gets a nod - States encouraged to restructure financial systems to improve sector as a whole and sign MoUs for the same effect.

Rs 25,000 cr to be raised through tax free bonds: Chidambaram

"Doing business in India must be seen as easy, friendly and mutually beneficial" - Second reference to increasing FDI in India. Government seems to betting heavily on a large FDI influx to help with the deficient

"We will use innovative and new financial methods to increase investment in infrastructure," says the Minister.

New steps have been announced to increase availability and amount of debts available for infrastructure projects.

The revised expenditure target is Rs 14,30,825 crore or 96 per cent of Budget estimate for this fiscal. In 2013—14, the budget estimate is Rs 16,65,297 crore.

Budget expenditure is Rs 16,65,297 crore and Plan expenditure Rs 5,55, 322 crore: FM.

Plan expenditure in 12th Five Year Plan revised to Rs 14,30,825 crore or 96 per cent of budgeted expenditure

We have brought down headline WPI inflation to 7 per cent and core inflation to 4.2 per cent. Food inflation is worrying: FM.

24.3 % hike in expenditure for health care both rural and urban health mission.

12.5 % hike in Scheduled caste and Scheduled tribe sub-plans

Overarching goal to create opportunities for youth to acquire skills for self-employment

All flagship programmes adequately funded. Ministries must take it forward.

Average economic growth rate in 11th Plan period is 8 per cent, highest ever in any Plan period.

Battle against inflation must be fought on all counts.

Foreign investment is imperative

Current account definict high due to dependence on oil , high gold imports

Need $75billion to bridge CAD

Present economic space is constrained by economic climate and tight monetary policy

Budgeting in hard times

TCA SRINIVASA-RAGHAVAN

When this Budget is compared with budgets of the past prepared under similar trying circumstances, Chidambaram has done a very good job indeed.

Having covered, in one way or another, 33 budgets since 1980 and, furthermore, having written their potted history since 1947 for the finance ministry, there are three things that I can assert with confidence.

First, budget analysis was much better before TV, with its instant analysis, came along.

True, that when budgets were presented at 5 p.m., analysts for newspapers also didn't get much time. But they at least didn't sound off without even a look at that little booklet called Budget at a Glance, leave alone the Finance Bill and the Explanatory Memorandum.

Second, the budget division of the finance ministry gets its numbers right.

In the mid-1980s, acting on the orders of a super-aggressive editor, I had tried to pick holes in the numbers, only to be told the next day by a family friend who was also a very senior official in the budget division not to be a "fool" (muttal). He was right.

Third, budgets are about taxes, and to comment on them without a long hard look at the Finance Bill is simply too foolhardy. The mischief is in the details and, as Finance Minister P. Chidambaram has advised, patience, prudence and restraint pay rich dividends.

RAJIV'S LEGACY

Few know it but Mr. Chidambaram was faced with an extremely hard task and when this Budget is compared with budgets of the past prepared under similar trying circumstances, he has done a very good job indeed.

India generally responds well to hard times, especially the hard times caused by external factors. There have been some notable exceptions, of course.

In 1979, Charan Singh presented a budget that failed completely to take into account the doubling of international oil prices. It was left to R. Venkatraman in 1980 to come up with some sensible policies.

In 1988 and 1989, Rajiv Gandhi who could not decide when to hold a general election — in 1988 or after a full term in 1989 — forced his finance ministers (two in two years) to present disastrously populist budgets that hugely bloated the budget deficit, as it was called then.

In 1990, the V. P. Singh government, advised by none other than finance secretary Bimal Jalan, also failed to take into account the looming disaster.

In 1991, Yashwant Sinha (under Prime Minister Chandra Shekhar) was actually prevented by Rajiv Gandhi from presenting a budget. Rajiv, in spite of pleadings by the Government, had decided to pull it down.

That aborted 1991 budget was full of sensible ideas. The credit for it went in July to Manmohan Singh. Likewise, Mr. Sinha's 1998 budget, in the aftermath of the Asian crisis of 1997, was also a sensible one.

THE MACRO BALANCE

That is why it is crucially important to look at Mr. Chidambaram's 2013 budget from the perspective of macro-economic management. The fact is that India is highly vulnerable today to a balance of payments crisis by the end of the year.

In plain language, the economy has to contract just as it had to in 1980, 1991, and 1998. The problem is that in the last few years we have become so addicted to growth that the finance minister cannot make bold to say so. Messrs Venkatraman (1980), Manmohan Singh (1991) and Sinha (1998) were not faced with a similar constraint.

So, while Mr. Chidambaram talked — a little sheepishly, I thought — of growth of over 6 per cent but below 7 per cent — he has made sure that this will not happen. Six per cent, we could live with but anything more than that is going to be a problem.

The reason is simple: we are not exporting enough because the world is not buying enough but we are importing a lot.

Until the global economy turns around, therefore, India has a serious problem of meeting its bills. So it has to suppress aggregate demand without actually saying so.

Judged by that yardstick, Mr. Chidambaram has done what he had to. He has put the national interest before that of his party's.

Of course, there will be some collateral damage to business but that's the way the game is played — roughly, if you want to do the right thing.

tca.tca@gmail.com

http://www.thehindu.com/business/Economy/budgeting-in-hard-times/article4472061.ece

Budget 2013-14: Middle class will pay more

AT first glance, the budget may appear harmless to the middle-class. In fact, it might even appear friendly what with all those improvements in housing loan deductions and stock market investments. But make no mistake, this budget will bite the average citizen in more ways than one.

Pay more to eat

Just take the seemingly innocuous proposal to impose service tax on all air-conditioned restaurants. With most decent restaurants — we are not talking of the up-market ones here — climate-controlled, eating out will become at least another 12 per cent more expensive. Remember that restaurants are in the process of revising their price-lists even now with rising prices of food commodities.

Pay more to talk

Cellular phones are now a necessity and smartphones are increasingly becoming so as they help you do your daily business on the go. As much as 97 per cent of all telephone connections in the country are cellular. Yet, smart phones (or phones that cost more than Rs.2,000) will now become pricier with the sharp rise in excise duty to 6 per cent from 1 per cent. Apart from driving business to the grey market, this proposal will also undo the efforts to push people into using their mobiles extensively for transactions.

Pay more to watch

Mr. Chidambaram has also not spared entertainment. The four metros are now compulsorily digitised for cable connections but the Finance Minister has doubled the import duty on set-top boxes to 10 per cent making them costlier in an environment where the citizen has little choice but to comply. Never mind that the country may not have enough capacity to produce set-top boxes on the scale required. The priority is to protect those who are in that business.

Pay more to travel

Apart from these, the allocation made for fuel subsidy is also lower which means that the Centre is well set on its course of freeing prices of petroleum products. This, in turn, means that diesel and cooking gas will see a sustained rise in price if global oil prices do not retreat.

Mr. Chidambaram has also made property transactions more cumbersome. Henceforth, buyers of immovable property will have to deduct a tax of 1 per cent of the sale value where it exceeds Rs.50 lakh and remit it to the tax department.

With the pain, some gain

Balancing these proposals that will be painful to the middle-class as a whole, are the ones that will cheer a section — investors — and those planning to buy a house. The tweaked Rajiv Gandhi Equity Savings Scheme appears friendlier and will help those looking to invest in the stock market and also get a tax-break in the process. The reduction in securities transaction tax and the soon-to-come inflation-indexed bonds should also cheer up investors.

Similarly, the generous interest deduction on housing loans of Rs.1 lakh, in addition to the Rs.1.5 lakh already available, will go a long way in pushing the fence-sitters to invest in a house.

http://www.thehindu.com/news/national/budget-201314-middle-class-will-pay-more/article4463245.ece

Major cut in fuel, food, fertilizer subsidies

SUJAY MEHDUDIA

Clear indication of a move toward the direct cash transfer regime countrywide

With the direct cash transfer (DCT) scheme expected to plug leakages and bring down the subsidy bill, the government on Thursday introduced a major cut in food, fuel and fertilizer subsidies by over 11 per cent at Rs. 2.20 lakh crore in 2013-14 as against the revised estimates of Rs. 2.47 crore this fiscal, a move aimed at containing the fiscal deficit.

The cut in subsidies was a clear indication that the government intended to move to the DCT regime countrywide. Unveiling the budget, Finance Minister P. Chidambaram said the government's subsidy bill on food, petroleum and fertilizers was estimated at Rs. 2,20,971.50 crore for the 2013-14 fiscal as against Rs. 2,47,854 crore in the revised estimates (RE) for this fiscal. The RE for this fiscal are higher by 38 per cent compared to the budget estimate of Rs. 1,79,554 crore.

The oil subsidy, which is given to the state-run oil marketing companies (OMCs) such as Indian Oil Corporation, BPCL and HPCL, for selling diesel, domestic LPG to households and kerosene at a subsidised cost is estimated at a lower Rs. 65,000 crore for the next fiscal against the revised estimate (RE) of Rs. 96,880 crore. The decrease in the subsidy component has been mainly due to less compensation to oil companies for under recoveries.

National food security

The food subsidy given to run the public distribution system is estimated at Rs. 90,000 crore next fiscal from the RE of Rs. 85,000 crore in 2012-13. The increase in food subsidy is mainly towards provision for national food security, according to the budget document. It is to meet the difference between the economic cost of foodgrains and their sales realisation at the Central Issue Price fixed under the PDS and other welfare schemes.

Fertilizer subsidy has also been pegged slightly lower at Rs. 65,971.50 crore in the next fiscal, as against the RE of Rs. 65,974 crore in 2012-13 fiscal. The government would provide Rs. 15,544.44 crore for imported urea, Rs. 21,000 crore for indigenous urea fertilizers and Rs. 29,426.86 crore for the sale of decontrolled fertilizers (DAP, MoP and complexes) at a subsidised rate to farmers.

Sharp criticism

The decision to lower fertilizer subsidy came in for sharp criticism from the industry players. The Fertilizer Association of India (FAI) has said the amount is less compared to the subsidy payments due for this fiscal as well as the payments for the 2013-14 financial year. "This amount will not be enough as there are already huge outstanding bills to the tune of about Rs 30,000 crore pending for 2012-13 and if we add to it the real requirement for the next fiscal, then this amount will not do," FAI Director General Satish Chander.

Faced with a cash crunch, the Fertilizer Ministry has arranged for a Rs. 5,000-crore bank loan for fertilizer companies which have not been paid full subsidy for about six months. While loans would be taken by the companies, the government would bear most of the interest they would have to pay. Subsidy bills have not been paid for phosphatic and potassic (P&K) fertilizers such as muriate of potash (MoP) and di-ammonium phosphate (DAP) since July and for urea since August.

http://www.thehindu.com/news/national/major-cut-in-fuel-food-fertilizer-subsidies/article4462708.ece

Budget pays lip service to food security

GARGI PARSAI

Although Finance Minister P. Chidambaram has pledged an additional amount of Rs. 10,000 crore to meet the requirement of providing concessional foodgrains to only identified beneficiaries under the proposed National Food Security Bill, it appears that he has garnered this sum by curtailing the annual budgeted Public Distribution System food subsidy requirement of the Department of Food.

The food subsidy budgeted for 2013-14 is Rs. 80,000 crore, and compared with the Rs. 85,000 crore projected in the revised estimates for 2012-13, this indicates a reduction of Rs. 5000 crore.

Having made this reduction, the Minister has, therefore, allocated only an additional Rs. 5000 crore for the food subsidy bill. According to informed sources, the annual budgeted subsidy estimate of the ministry for 2013-14 was around Rs. 90,000 crore. As against this, the allocation is for Rs. 80,000 crore.

The estimated requirement of food subsidy in the government's National Food Security Bill was Rs. 1,17,000 crore for distribution of 7 kg of foodgrains per person per month.

Subsidy demand

The Parliamentary Standing Committee, to which the Bill was referred, projected a subsidy demand of Rs. 1,12,000 crore for the distribution of 5 kg foodgrains per person per month. They suggested coverage of 67 per cent of the population.

By all accounts, the food bill subsidy allocation should be between ideally Rs. 20,000 to Rs. 30,000 crore, unless the government intends to reduce the number of beneficiaries.

http://www.thehindu.com/news/national/budget-pays-lip-service-to-food-security/article4463861.ece

Look beyond foreign investors

The mystique that stock markets seem to hold for lay people and policymakers alike gets magnified several times over in budget season. There is, most certainly, no rational basis for this. Though devoid of real significance, the share markets' verdict on the budget in the minutes and hours after the Finance Minister's speech continues to be extremely important to policymakers. This has been amply demonstrated again by the urgency shown by P. Chidambaram and his team in allaying concerns over a provision in the Finance Bill that seems to cast doubts on the validity of residency certificates that benefit investors routing their investments through tax treaty centres such as Mauritius. On budget day, the sharp decline in share indices was attributed to just this single provision. The fact that the concerns are confined to foreign investors and tax havens used by them says it all. The broader market and the government are explicitly acknowledging the importance of these investors. It is, therefore, not surprising that in his budget speech, the Finance Minister gave his proposals relating to the broad category of foreign investors pride of place among financial sector announcements. None of them — and virtually none of the financial sector announcements — made reference to financial outlays but are nevertheless important for the policy direction they reveal.

In moving towards internationally accepted definitions of foreign institutional investment (FII) and foreign direct investment (FDI), the government is facilitating larger foreign inflows especially in sectors that have an FDI cap. Foreign investors may not have got their entire wish list. The much-anticipated announcement to expand the role of FIIs in the debt market did not materialise. But the package for them looks very impressive when contrasted with what is available for domestic investors, especially the retail ones. There has been once again a proposal to simplify the procedures for small and medium enterprises to access their dedicated exchange. More significant, in the context of infrastructure funding, is the proposal to start a dedicated debt segment in the stock exchanges. The facilities being accorded to foreign capital can be justified in the current macroeconomic context of the widening current account deficit. Yet the economy needs domestic investors too, not just the large ones but retail investors, who should ideally be the backbone of any well developed capital market. The ambitious disinvestment target next year, of Rs.40,000 crore, brooks no delay in enhancing the retail participation in the markets.

RELATED NEWS

http://www.thehindu.com/opinion/editorial/look-beyond-foreign-investors/article4472248.ece

-

Financial Express-28-Mar-2013 As the government mulls a step-up in the divestment programme, it may be appropriate to assess the results of the program in India to date ... |

| * | -

Business Standard-23-Mar-2013 The first year of disinvestment in 1991-92 recorded total proceeds of Rs 3,038 crore, while the cumulative amount raised under this programme ... |

* * | -

Business Standard-26-Mar-2013 State-owned Life Insurance Corporation (LIC) has played a key role in helping the government achieve the disinvestment target of Rs 24,000 ... |

| * | -

Zee News-22-Mar-2013 New Delhi: Aided by LIC's bulk purchase, the government's truncated disinvestment in SAIL Friday managed to go past the muster and help ... + Show more |

-

Moneycontrol.com-25-Mar-2013 HSIL Ltd has informed BSE that the Company has disinvested/sold its entire investment in equity shares of its wholly owned subsidiary, AGI ... |

* *-

Moneycontrol.com | -

NDTV-19-Mar-2013 New Delhi: A crucial meeting of an inter-ministerial panel that was scheduled on Tuesday on disinvestment of government's 10.82 per cent ... + Show more |

-

The New Indian Express-19-Mar-2013 While the BJD criticised the UPA for its insistence on disinvestment of Nalco, the Congress members alleged that the process was started when ... + Show more |

* * | -

Business Standard-14-Mar-2013 The officers' association of National Aluminium Company (Nalco) vowed not to allowdisinvestment of the aluminium major even as the firm's ... + Show more |

* * | -

Economic Times-07-Mar-2013 MUMBAI: Shares of potential disinvestment candidates such as MMTC, Nalco, SAIL, and RCF have taken a battering and are trading at ... + Show more |

-

Business Standard-13-Mar-2013 "We have been opposing Nalco disinvestment time and again and will continue to do so. It is very unfortunate that a profit making navratna ... |

Critical reforms needed to boost business

Hemali Chhapia, TNN | Mar 31, 2013, 10.31AM IST

MUMBAI: The 82nd Business Outlook Survey is based on the responses from 175 members. "For matching up to the government growth estimates for the next fiscal, it is critical that we remain focused on introducing the critical reform measures. The Union Budget 2013-14 has indeed covered some distance in this direction, but more measures are warranted" stated Chandrajit Banerjee, Director General, Confederation of Indian Industry.

On inflation front, there are no major surprises. 42 per cent of respondents expect average WPI inflation to lie in a range of 7.0-8.0 per cent in the current fiscal. For 2013-14, however, most of the respondents (37.4 per cent) expect inflation to moderate and come down in a range of 6.0-7.0 per cent, which should help RBI to focus more on growth revival next year.

Even as the government remains committed to adhering to target of fiscal consolidation, majority of the respondents (62.4 per cent) expect the fiscal deficit to exceed the budgeted estimate of 4.8 per cent next fiscal. On the current account deficit too, the survey does not paint a rosy picture, with most of the respondents expecting it to lie in a range of 4.0-5.0 per cent of GDP in both current as well as next fiscal.

Majority of the respondents in the survey saw improvement in their sales, new orders, exports and value of production in the fourth quarter of 2012-13 from the levels of previous quarter. This is perhaps driven by the improvement in both domestic as well as international economic environment.

The worrying factor, however, is the upward pressure expected in input prices in the wake of elevated inflation, high international crude oil prices, and low value of rupee. Further, overwhelming majority (76.3 per cent) of the respondents saw credit availability to remain either stagnant or become tight during the ongoing quarter, highlighting the need for easing the liquidity condition in the economy by the RBI.

At a time when reviving investment and economic growth has assumed critical importance, majority of the respondents (62.2 per cent) said that their investments is either expected to decline or remain constant during the fourth quarter.

Instead of adding new capacity, businesses have apparently focused on better capacity utilization. Nearly half (49.5 per cent) of the respondents saw their capacity utilization in the fourth quarter improving to 75-100 per cent as compared to 50-75 per cent in the previous quarter. "While expected improvement in capacity utilization is a positive sign, policy efforts need to be focused on restarting the investment cycle", suggested Banerjee.

http://timesofindia.indiatimes.com/business/india-business/Critical-reforms-needed-to-boost-business/articleshow/19303034.cms