Indian Holocaust My Father`s Life and Time -Two Hundred SIXTEEN

Palash Biswas

http://indianholocaustmyfatherslifeandtime.blogspot.com/

| The split reality |

| Adivasis, Salva Judm and the State: who is provoking whom? |

| Some news is considered more worth publicizing than some other news. This is part of an essential discipline, for otherwise we will remain perennially buried under an avalanche of data, information and gossip. The wheat, never mind the change of meta... | Read.. http://www.telegraphindia.com/1091120/jsp/opinion/index.jsp |

|

Banking & Finance

FM suggests merger plans for banks

NEW DELHI: The Finance Minister, Mr Pranab Mukherjee on Wednesday said bank managements should come forward with proposals for mergers to facilitate consolidation in the banking sector.

"The initiatives for consolidation in the banking sector have to come from the management of banks themselves," he told a meeting of the heads of state-run banks and financial institutions.

As regards the role of the government in the merger of banks, the Minister said, "The government would only play a supportive role as a common shareholder."

The process of consolidation of banks, Mr Mukherjee added, "may be necessary to improve the state of competitiveness of Indian banks globally and also to reduce the risk to financial stability".

Replying to questions from media on the issue of consolidation of public sector banks, Finance Secretary, Mr Ashok Chawla said, "There is scope for consolidation of public sector banks... the initiatives must be from the bank managements."

The government, Mr Chawla added, "will be happy to facilitate" merger of public sector banks. Besides State Bank of India (SBI) and its six associate banks, there are 20 nationalised banks in the country.

Large nationalised banks include Punjab National Bank, Canara Bank, Bank of Baroda and Bank of India. - PTI

Call to resist merger of public sector banks

THIRUVANANTHAPURAM: Law Minister M. Vijayakumar has called upon the bank employees to resist the Central Government move to merge public sector banks as it would destroy the banking sector. Inaugurating the `Navagatha sanghom' of the State Banks' Staff Union here on Sunday, he said that this policy went against the basic concept of bank nationalisation. The present move for merger of banks was part of implementing the hidden agenda in league with international agencies, he alleged Union president A.Jayakumar presided over the function. Union general secretary K. Raja Kurup and assistant general secretaries Jyothikumar and S.S. Thampi spoke at the function. C.Rajendran and M. Raghavan took classes.

| ||||||

| ||||||

| ||||||

Article: Banking regulation: an overall perspective. (Research Rap).

Article from:Business Review (Federal Reserve Bank of Philadelphia) Article date:September 22, 2002CopyrightCOPYRIGHT 2002 Federal Reserve Bank of Philadelphia. This material is published under license from the publisher through the Gale Group, Farmington Hills, Michigan. All inquiries regarding rights should be directed to the Gale Group. (Hide copyright information)Ads by Google

Full-Text Online Journals

Research online. Academic journals & books at Questia Online Library.

www.Questia.com/Journals

Basel 2 Implementation

Basel 2 Software Implementation & Consulting

www.g-stat.com

In this paper, Xavier Freixas and Anthony M. Santomero explore the important changes taking place in banking regulation as a result of ongoing financial innovation and the evolution of a more sophisticated system of regulation. They apply asymmetric information theory--a paradigm in which economic agents are presumed to operate in a world of incomplete, and sometimes biased, information--to issues central to the theory of banking.

The authors review the impact of such imperfect information on our ...

BANKING REGULATION BILL INTRODUCED (to give more operational flexibility to the RBI in the conduct of monetary policy).

Ads by Google

The Economist Magazine

The Economist At Rs.80 Per Week Subscribe Now & Make The Most Of It

Economistsubscriptions.com

New Job in Banks

100s of Bank Openings Submit Resume to Apply

MonsterIndia.com

FedEx IBL Challenge

Do you think you are a Business Champion? Then Enter FedEx IBL!

InternationalBusinessLeague.com

(From India Business Insight)

The Government of India has introduced a bill seeking to give more operational flexibility to the Reserve Bank of India (RBI) in the conduct of monetary policy.

The Banking Regulation (Amendment) ...

Related newspaper, magazine, and trade journal articles from HighBeam Research

(Including press releases, facts, information, and biographies)

Searching more than 100 credible sources

| |  | f_doctitle |

|  | Cabinet approves changes in Banking Regulation and RBI Bill. News Wire article from: PTI - The Press Trust of India Ltd. ...approves changes in Banking Regulation and RBI Bill New...amendments to the Banking Regulation (Amendment...to give greater operational flexibility and regulatory...meeting. The Banking Regulation (Amendment... |

|  | CABINET GIVES NOD TO AMEND BANKING REGULATION BILL News Wire article from: The Hindustan Times ...amendments to the Banking Regulation (Amendment...accord greater operational flexibility and regulatory...of India. The Banking Regulation (Amendment...provisions in the Banking Regulation Act, 1949 have... |

|  | Banking Regulation Bill introduced. News Wire article from: PTI - The Press Trust of India Ltd. Banking Regulation Bill introduced...seeking to give more operational flexibility to the Reserve Bank...Chidambaram. The Banking Regulation (Amendment) Bill...section 24 of the Banking Regulation Act, 1949 to enable... |

|  | Banking Regulation Bill gets LS nod. News Wire article from: PTI - The Press Trust of India Ltd. Banking Regulation Bill gets...give more operational flexibility to the Reserve...today. The Banking Regulation (Amendment...would give operational flexibility to RBI in...amendments in the Banking Regulation Act, 1949... |

|  | The Future of Banking Regulation: The Basel II Accord - Get Answers To The Mounting Questions About The Future Of International Banking Regulation. M2 Presswire ...Research and Markets: The Future of Banking Regulation: The Basel II Accord - Get Answers...About The Future Of International Banking Regulation(C)1994-2009 M2 COMMUNICATIONS...Ltd's new report "The Future of Banking Regulation: The Basel II Accord" to their... |

|  | Greater international links in banking--challenges for banking regulation. Magazine article from: Economic Papers - Economic Society of Australia ...as a primarily domestic activity. Banking regulation for the most part also grew with...can arise when integrating their banking regulation. Hopefully, these issues can stimulate...Short History of Modern Australian Banking Regulation Modern banking regulation in ... |

|  | The creation of homeownership: how new deal changes in banking regulation simultaneously made homeownership accessible to whites and out of reach for blacks. Magazine article from: Yale Law Journal ...MORTGAGES A. Why FHA-Insured Loans Were Illegal B. Federal Banking Regulation: National Banks C. Federal Banking Regulation: Access to Credit for Thrifts D. State Banking Regulation E. How Changing Banking Regulation Transformed the National... |

|  | The Future of Banking Regulation: the Basel II Accord - Get Answers to the Mounting Questions about the Future of International Banking Regulation.(Report) Newspaper article from: Investment Weekly News ...John Wiley and Sons Ltd's new report "The Future of Banking Regulation: The Basel II Accord" to their offering. This up...the mounting questions about the future of international banking regulation. The Basel II Accord is a new system designed to determine... |

|  | Research and Markets: The Future of Banking Regulation: the Basel II Accord - Get Answers to the Mounting Questions about the Future of International Banking Regulation. Business Wire ...John Wiley and Sons Ltd's new report "The Future of Banking Regulation: The Basel II Accord" to their offering. This up...the mounting questions about the future of international banking regulation. * The Basel II Accord is a new system designed to determine... |

|  | CHINA, RUSSIA SIGN MEMO ON COOPERATION IN BANKING REGULATION News Wire article from: AsiaInfo Services ...Russia Sign Memo on Cooperation in Banking Regulation BEIJING, Nov 09, 2005 (SinoCast...understanding on the cross-border banking regulation on November 3, 2005, expanding...China has signed cross-border banking regulation with the US, UK, Canada, Germany... |

Banking Regulation Bill introduced

A bill seeking to give more operational flexibility to the Reserve Bank of India in the conduct of monetary policy was introduced in Lok Sabha on 9th March 2007 by the finance minister, P Chidambaram.

The Banking Regulation (Amendment) Bill proposes to replace an ordinance promulgated on January 23 this year. The ordinance seeks to amend section 24 of the Banking Regulation Act, 1949 to enable the RBI to specify the Statutory Liquidity Ratio without any floor rate.

Changes proposed in section 53 of the Act will make it mandatory to present draft notification before both Houses of Parliament in cases of exemptions being granted to institutions, banks or branches located in Special Economic Zones (SEZs).

Chidambaram said it was necessary that the RBI, as the regulator and the authority vested with the powers to conduct monetary policy, has the necessary flexibility regarding stipulation of holding of liquid instruments by banks.

Floor limit on SLR of banks was removed in January 2007, by an presidential decree and the government was required to move a bill within six months under the law ... Read more.

http://www.banknetindia.com/banking/70314.htm

Financial sector bills to be priority agenda for new govt

Tags : Financial sector bills to be priority agenda for new govt Posted: Tuesday , May 05, 2009 at 0120 hrs Suneeti Ahuja & Gunjan Pradhan SinhaThe department of banking and insurance in the ministry of finance has drawn out a list of pending reforms to be submitted to Cabinet Secretary KM Chandrashekhar later this month. Most of these involve legislative action and perhaps call for changes depending on the nature of the coalition at the Centre.

The Micro-finance Development and Regulation Bill, Banking Regulation (Amendment) Bill and the State Bank of India (Amendment) Bill need to be re-introduced in Parliament once the new government assumes power. The Insurance Development and Regulation Bill may, however, retain its original form. The UPA government introduced it in the Rajya Sabha last December to prevent it from lapsing.

All these bills hold great significance and take forward India's unilateral commitment to pursuing financial sector reforms.

The Micro-finance Development and Regulation Bill seeks to facilitate universal access to integrated financial services in rural and urban areas that lack banking facilities. It also seeks to regulate micro finance organisations (MFO) that are not regulated. It also aims to bring under its purview societies, trusts and cooperatives.

http://www.indianexpress.com/news/financial-sector-bills-to-be-priority-agenda/454574/Results 1 - 10 of about 169,000 for nationalised banks. (0.14 seconds)

Search Results

Nationalised Banks | Indian Nationalised Banks | National Banks In ...

Nationalised in 1980, Corporation Bank was the forerunner when it came to evolving and adapting to the financial sector reforms. ...

explore.oneindia.in/finance/banks/nationalisedbanks/ - Cached - Similar -Indian Public Sector Banks, Nationalised Banks, List & Directory ...

Directory of Public Sector Banks- Links to all Nationalised Bank Websites 1. Allahabad Bank - Click here 2. Andhra Bank - Click here ...

www.banknetindia.com/pubbanklinks2.htm - Cached - Similar -Nationalised Banks in India - Nationalised Banks - Public Sector ...

Nationalised banks dominate the banking system in India. The history of nationalised banks in India dates back to mid-20th century, when Imperial Bank of ...

www.iloveindia.com/.../bank/nationalised-banks/index.html - Cached - Similar -News results for nationalised banks

Govt kicks off talks on bank consolidation - 1 day ago

Sources said finance ministry officials met the chairmen of the five largest nationalised banks — Punjab National Bank, Canara Bank, Bank of Baroda, ...Business Standard - 29 related articles »

Nationalised Banks - Banking & Insurance - Citizens: National ...

This section provides various links to the website of some of the major banks in the public sector in India.

india.gov.in/citizen/nationalisedbank.php - Cached - Similar -what are nationalised banks?

- 7:19am14 banks are nationalised banks in india. there are canara bank,karnataka bank,state bank of india,indian bank and many more ...by ...

www.allinterview.com › Categories › Business Management - Cached - Similar -Nationalisation Of Banks In India

The nationalisation of banks in India took place in 1969 by Mrs. Indira Gandhi the then prime minister. It nationalised 14 banks then. ...

finance.indiamart.com/...in.../nationalisation_banks.html - Cached - Similar -Nationalised Banks in India, List of Nationalised Banks

Nationalized Banks plays an important role in banking sector.List of Nationalised Banks includes State Bank of India, Indian Overseas Bank, Allahabad Bank, ...

www.info2india.com/.../banks/nationalised-banks/index.html - Cached - Similar -Banks & financial institutions - Directory of official web sites ...

Nationalised Banks. Allahabad Bank · Andhra Bank · Bank of Baroda · Bank of India · Bank of Maharashtra · Canara Bank · Central Bank of India ...

goidirectory.nic.in/bankfin.htm - Cached - Similar -Nationalised banks in India and financial information statistics

Operating and Net Profit before and after Adjustment of Interest of Recapitalisation Bonds of Nationalised Banks in India (2006-2007 and 2007-2008) ...

www.indiastat.com/banksandfinancialinstitutions/.../nationalisedbanks/.../stats.aspx - Cached - Similar -Fixed Deposits Rates - Nationalised Banks

Nationalised Banks. Private Banks ... Fix Deposit Rates - Nationalised Banks ... Central Bank of India, 6, 6.5, 7, 8, 9.5, 9.5, 10.5, 10.5, 10.5 ...

www.thebharat.com/finance/fixeddeposits/nationalbanks.html - Cached -

| Searches related to: nationalised banks | |||

| andhra bank nationalised bank | idbi nationalised bank | sbi nationalised bank | nationalisation banks 1969 |

| hdfc nationalised bank | nationalised banks mumbai |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | Next |

Results 1 - 10 of about 11,300 for PSU nationalised banks in India. (0.32 seconds)

Search Results

18 PSU banks seek capital infusion

13 Oct 2009 ... 18 PSU banks seek capital infusion. Press Trust of India / New Delhi ... Almost all the nationalised banks are seeking fresh infusion of ...

www.business-standard.com › Home › Banking & Finance - Cached -18 PSU banks seek capital infusion

Banks tweak ATM strategies. State-owned banking sector comprises 20 nationalised banks, State Bank of India and its six subsidiaries. ...

sify.com/.../18-psu-banks-seek-capital-infusion-news-bank-jkoivOjhjij.html - Cached -The Hindu Business Line : More car makers partner PSU banks for ...

13 Feb 2009 ... Hyundai Motor India too has getting into such arrangements with the nationalised banks, even as private sector banks have slowed down on car ...

www.thehindubusinessline.com/.../2009021351500200.htm - Cached - Similar -IT majors trust PSU banks for their Rs20,000 cr cash - Home ...

1 Feb 2009 ... IT majors trust PSU banks for their Rs20,000 cr cash, TCS, Infosys, ... in nationalised banks in India," Infosys CFO V Balakrishnan said. ...

www.livemint.com/2009/02/.../IT-majors-trust-PSU-banks-for.html - Cached -Bank Branches Of Nationalised, Private And Foreign Banks In India ...

21 Sep 2009 ... Related to : Bank Branch, Banks, Private Banks, PSU Banks, Foreign Banks, Nationalised Banks, Branches Contact : K. Amit ...

www.clickindia.com/detail.php?id=655201 - Cached -Every second loan's from a nationalised bank - Worldnews.com

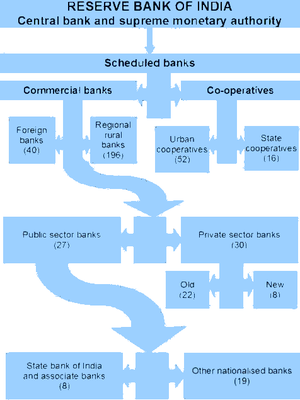

22 Aug 2009 ... Banks in India are classified into four categories by the Reserve Bank of India (RBI) --- nationalised, private, foreign and the State Bank ...

article.wn.com/.../Every_second_loans_from_a_nationalised_bank/ - Cached -PSU banks shy away from funding, sans collateral

Mumbai, Dec 30: Despite the phenomenal growth in the country's retail sector, India's nationalised banks continue to shy away from funding the retail ...

www.financialexpress.com/.../PSU%20banks%20shy%20away%20from%20funding.../153628/ - Cached -PSU Banks | Cashcow.in

bank in India, and now the Bank is making its moves to capitalise on its ... The group of PSBs includes nationalised banks, SBI & Associates and . ...

www.cashcow.in/index.php/category/psu-banks/ - Cached -IT majors trust PSU banks more for their Rs 20000 crore cash

IT majors trust PSU banks more for their Rs 20000 crore cash. ... of our portfolio is kept in nationalised banks in India," Infosys CFO V Balakrishnan said. ...

discuss.itacumens.com › ... › IT Market Updates - Cached -State-run banks line up to manage PSU stake sales | mydigitalfc.com

17 Jun 2009 ... "Banks such as State Bank of India, Union Bank of India, Citibank and JP Morgan have shown interest. Most of the nationalised banks want to ...

www.mydigitalfc.com › My World - Cached -

| Searches related to: PSU nationalised banks in India | |||

| icici nationalised bank | hdfc nationalised bank | sbi nationalised bank | nationalised banks in mumbai |

| nationalised banks in pune | axis bank nationalised bank | nationalised banks in chennai | home loan nationalised bank |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | Next |

Nationalised Banks Face Tougher Challenges

17 Jun 2001 ... THE public sector banks in India today are in deep trouble as their .... most conveniently want to use to privatise the nationalised banks. ...

pd.cpim.org/2001/june17/june17_banks.htm -'India survived slowdown because of banks nationalisation' news

'India survived slowdown because of banks nationalisation'. ... Finance Minister Pranab Mukherjee Sunday ruled out privatisation of state-run banks and said ...

newshopper.sulekha.com/.../india-survived-slowdown-because-of-banks-nationalisation.htm - Cached -Repeal Bank Nationalisation Act: 10th Plan

As it would take some time to privatise all public sector banks, ... The State Bank of India (SBI) was nationalised in July 1952 under the SBI Act of 1955. ...

www.financialexpress.com/...bank-nationalisation-act.../51205/ - Cached - Similar -We have been watching for a long time that, efforts were being ...

When the banks were nationalised in 1969, the Congress Party was divided an ... the Government was trying to privatise Industrial development Bank of India ...

parliamentofindia.nic.in/ls/lsdeb/ls10/ses6/1322039305.htm - Similar -The Italian Puzzle: From Nationalisation to Privatisation

Nationalisation or privatisation is a policy response of the government to manage ... to banks giving further credits to the fail- ing firms to save them. ..... veloping countries, and particularly India. In India too, public sector was ...

www.jstor.org/stable/4410005 -

by P Baijal - 2000 - Cited by 1 - Related articlesMeasure For Measure - INDIA TODAY

3 Jul 2006 ... From nationalisation to privatisation, from DD to cable TV, ... The nationalisation of the State Bank of India in 1955 was aimed at ...

www.india-today.com/itoday/20060703/economic.html - Cached -Global View Today!: The Nationalisation to Privatisation quagmire!

29 Jun 2009 ... The Nationalisation to Privatisation quagmire! ... In the U.K., Northern Rock, a mortgage lender, has been under public control since 2007 as well as the Royal Bank of Scotland (RBS), .... India dumping claims on China. ...

globalviewtoday.blogspot.com/.../nationalisation-to-privatisation.html - Cached -'India survived slowdown because of banks nationalisation ...

26 Jul 2009 ... 'India survived slowdown because of banks nationalisation' ... Pranab Mukherjee ruled out privatisation of state-run banks & said mkt ...

economictimes.indiatimes.com/.../India...banks-nationalisation/.../4822492.cms - Cached -Nationalization - Wikipedia, the free encyclopedia

1949 (1 January) Reserve Bank of India nationalised (Ref.- Reserve Bank of India chronology of .... The scheme was privatised by asset transfer in 1973. ...

en.wikipedia.org/wiki/Nationalization - Cached - Similar -The Hindu Business Line : Adviser doubts rationale of bank ...

16 Jan 2002 ... Adviser doubts rationale of bank privatisation. Our Bureau ... that support the concept of privatisation of public sector banks in India. ... the frequency and magnitude of recapitalisation of nationalised banks was down ...

www.thehindubusinessline.com/2002/01/.../2002011601020900.htm - Cached -

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | Next |

20/11/2009

Shiv Sena attacks IBN offices in Mumbai, Pune

Mumbai: A group of men suspected to be Shiv Sena activists attacked journalists and damaged property at the offices of IBN7 and IBN Lokmat, the Hindi and Marathi news channels of the IBN Network, in Mumbai and attacked the OB van of the channel in Pune on Friday afternoon.

According to reports, IBN Network journalists and other employees were beaten up and their clothes torn by the group. Attackers shouted slogans against the television channel broke the window panes and attacked the staff. The attackets were armed with iron rodes, baseball bats and cricket stumps.

Seven persons were arrested in connection with the attack on the Mumbai office of the channel and a couple of others were booked for the vandalism against the channel in Pune.

"We had no idea that such a thing was going to happen. Whoever is responsible for this will be severely dealt with. Nobody has the right to assault journalists," said Maharashtra Chief Minister Ashok Chavan.

Source: India-Syndicate

20/11/2009

Ram temple symbol of Sena's sacrifice for Hindutva: Thackeray

Mumbai: Ram temple at Ayodhya is a symbol of Sena's sacrifice for Hindutva and the party would fulfil the promise of constructing it fully, Shiv Sena chief Bal Thackeray has said.

"Ram temple is a symbol of Sena's sacrifice for Hindutva," an editorial in party mouthpiece `Saamana' said yesterday. Thackeray is the newspaper's editor.

Crediting Sena for bringing down the Masjid, Thackeray said, "Kothari brothers, who demolished the domes of Masjid and hosted a saffron flag there were Shiv Sainiks and I am proud of them."

Referring to SP MLA Abu Asim Azmi's announcement to rebuild Babri Masjid at Ayodhya, Thackeray said, "if someone is dreaming of rebuilding Babri Masjid, Sena has the power to shatter those dreams."

Thackeray described the assault on Azmi in Maharashtra Assembly by MLAs belonging to MNS as a "mild slap".

Source: PTI

Mamata to take up Railway Safety issue with Chidambaram

New Delhi, Nov 20 : Railway Minister Mamata Banerjee will take up the Railway safety issue with Union Home Minister P Chidambaram as it was an easy target for any miscreant group.

She said this against the backdrop of the naxalite attack which resulted in the derailment of eight bogies of the Tata-Bilaspur passenger train in Jharkhand's west Champaram district last night.

One person died while 25 were injured in the incident.

Talking to newspersons here today outside Parliament, Ms Banerjee said the Railway Ministry will take up the issue with the Home Minister, as every day there are kidnappings, obstractions and bomb blasts.

The Railway Minister said these issues should be resolved through talks.

Responding to questions, Ms Banerjee said security and law and order was a State subject. She said the Railway Protection Force (RPF) cannot even file an FIR. These are carried out by the Government Railway Police (GRP) where the Railways bear fifty per cent of their salaries and the balance is provided by the respective State Governments.

In response to another question, she said the prima facie evidence suggested that last night's attack was carried out by the naxalites.

The Railway Minister further disclosed that earlier it was feared that two person died in this attack but it has now been found that one of them is alive. The condition of three injured persons were critical.

The Railway Minister said railway property should not be damaged as the Railways cater to lakhs of people across the country.

--UNI

Sugar prices force three adjournments of Rajya Sabha

New Delhi

, Nov 20 : A united opposition forced three adjournments of the Rajya Sabha Friday, the last one for the day, as it vociferously protested the United Progressive Alliance's new sugar pricing policy.

However, Chairman Hamid Ansari managed to push through the business listed for the day before adjourning the house to meet at 11 a.m. on Monday.

Friday was the first full working day of the Rajya Sabha's winter session, having adjourned on the opening day Thursday after obituary references to three former members and late Andhra Pradesh chief minister Y.S. Rajasekhara Reddy.

The trouble began immediately after the house assembled Friday when Samajwadi Party MPs raised slogans against the new sugarcane pricing policy with party leader Amar Singh advancing to the well of the house.

However, Bharatiya Janata Party (BJP) MP S.S. Ahluwalia prevailed upon them to let nominated member H.K. Dua take his oath of office.

The MPs resumed their protest thereafter, refusing to heed to Ansari's appeals for calm. At 11.04 a.m., Ansari adjourned the house for 15 minutes.

Attendance on the treasury benches at the time was extremely thin, with only Agriculture Minister Sharad Pawar and Sports Minister M.S. Gill being the only ministers present.

Minister of State in the Prime Minister's Office Prithviraj Chavan and his counterpart in the railway minister E. Ahamed walked in just before the house resumed at 11.19 a.m. with the opposition protests continuing.

An exasperated Ansari said: "Please let me speak for two minutes. I have received a notice from the leader of the opposition that the question hour be suspended. The issue (sugar prices) is listed for a short duration discussion. We will take it up at the appropriate time."

This did not satisfy the opposition, which continued with its slogan shouting and Ansari, at 11.21 a.m., adjourned the house till 12 noon.

By that time, both Pawar and Gill had left the house and ministers of state Chavan, as also P. Purandeshwari (human resource development), Ajay Maken (home) and V. Narayanswamy (parliamentary affairs) were the only government representatives on the treasury benches.

In the midst of continuing protests, Ansari called for papers to be laid and 10 minutes later, adjourned the house for the day.

The central government has announced a price of Rs.129.85 per quintal for sugarcane during the 2009-10 crushing season under the Fair and Remunerative Price (FRP) system, while the Uttar Pradesh State Advisory Price (SAP) has been set between Rs.165 and Rs.170 per quintal.

In case a state government fixes SAP higher than the FRP, it will have to pay the difference.

Farmers want Rs.280 per quintal for their produce.

On Thursday, cane farmers from Uttaar Pradesh had marched from the Ramlila Ground to parliament to protest the new pricing policy.

Their leader, Rashtriya Lok Dal MP Ajit Singh, said: "Sugarcane farming in Uttar Pradesh is dependent totally on diesel and the price of diesel is touching the sky. In such a scenario if the farmers do not get an adequate price for their produce, the agitation is completely justified."

"Uttar Pradesh provides 40 percent of the total sugar in the country," he added.

--IANS

Privatisation of tax administration

Nov 20, 2009 Government Policy

In the present scenario, tax is a burden imposed by law. Since our present state rest on the Principles of Rule of Law, the tax administration does not remain a mere revenue collection exercise, it take the shape of administration of a branch of law. Thus the ideal taxation is execution of a well defined law with defined burden, legal-procedural-financial,on the subjects. When such law is administered by an inefficient and corrupt institution, it does not result in merely less collection of revenue but erosion of subject's faith in the existence of Rule of Law.

The taxation law affects the economic interest of the nation. When such laws is inefficiently administered, when such laws are administered by corrupt bureaucracy, when the drastic nature of such laws threat the liberty of businessmen; it results in lower business confidence, less investment, inefficient use of capital and ultimately result in lowering the growth rate of the nation. Numerous studies has been conducted and it has been found conclusively that institutional factors like Rule if Law, personal liberty, absence of corruption, efficientadministration propels the growth rate of any nation.

Thus on theoretical, moral and economic ground- there is a case for efficient and honest tax administration. We will not require any independent proof that our tax administration is neither efficient nor honest. This paper is an attempt to examine the possibility of private sector participation in the taxadministration so as to make is efficient and honest- and more so to inculcate the spirit that tax administration exist for the people.

PRIVATE COLLECTION OF TAXES:

Under Article 265 of the Constitution of India, the taxes are to be levied as per expressed provision of law. However, the machinery of taxcollection is based on convenience- there is no bar that private persons cannot collect taxes. On smaller taxes, like toll tax imposed by Municipality, at various places it is collected by private parties. Excise duty on country liquor is collected by private parties. In approximately 80 countries of the world, custom duty is privately collected. Thus it is perfectly legal if tax collection is privatized. However, for the purposes of this paper, the author is confining itself to certain processes which can be easily privatized, without unduly affecting the present tax structure.

Receipt of Communication:

A tax payer is required to give certain communication to the department like application of registration, periodical returns, intimations, reply to departmental communications etc. Any person who visits the departmental office has a horrowing experience in getting a receipt of the communication. Citizen's Charter says that communications shall be acknowledgedon the spot. However, every assessee knows that how difficult is to get a receipt of communication. I feel that certain private agencies, like post office, or banks or even private companies can be authorized to receive such communication on behalf ofthe department. Thus the department will be saved of many visitors in the office, the assessee will be saved from undue harassment, interface of tax payer and taxmen will be reduced leading to reduced corruption, more accountability ofthe department etc. Further, the scheme can be self financing as a user fee can be imposed, like Rs. 50 per communication.

Another problem is with E-Mail communication. The supplementary instruction of the department says that communication can be sent via E-Mail. However, the departmental officers never reply to the mail. Whether, they reply or not, it is there problem. The assessee must get an acknowledgement of the sent mail. The official mail boxes of the officers can be given a facility of auto reply of acknowledgment.

Registration Certificate:

Registration of unit is a first point where an assessee meets the department, and this meeting ordinarily not very pleasant. As per the departmental instructions, the registration certificate is required to be issued immediately and verification is done after registration. There are well defined documents which are required at the time of registration. This process may be privatized, and private persons can be empowered to issueregistration certificate. After such registration, the department can do the verification and if any anomaly is found, appropriate action can be taken.

Thus we can examine various processes, which are simple and does not have revenue amplifications which can easily be privatized. Even other processes like dispute settlement, adjudication, audit etc. can also be privatized without much difficulty, but examination of those processes are beyond the purview of this paper. A beginning can be made with simple processes. If the government of the day is really a government of common man, and interested in transparent governance it will certainly take some positive steps in the direction.

Written by:- Advocate Rajesh Kumar. The author can be contacted on The author can be contacted on custom.excise@gmail.com , Web: www.rajeshkumar.co.in

Insurance Law Amendment Bill and Banking Regulation Amendment Bill unlikely to taken up in the winter session of Parliament. Banks are all set for Disinvestment and Merger. But the Government of India Incs seem to bypass the parliament as they had been to hand over Indian Economy to the FIIs abolishing the FDI cap keeping the Cabinet in dark.Privatisation of tax administration is also on cards!

http://www.taxguru.in/government-policy/privatisation-of-tax-administration.html

Sources said finance ministry officials met the chairmen of the five largest nationalised banks — Punjab National Bank, Canara Bank, Bank of Baroda, Bank of India and Union Bank of India — to help the government prepare a roadmap. Nationalised banks refer to private banks that the government took over.

Bankers told the finance ministry officials that as the majority owner, the government should consider issues such as geographical synergy, culture and a technological fit before deciding on alliance partners.

Although the government has been talking of bank consolidation for over half-a-decade, the earlier Manmohan Singh-led alliance could not go ahead with the move, owing to opposition from the Left parties.

Trade unions are Silent and play the most Proactive Role to Push for Economic reforms as Communist leaders from around the world met in New Delhi Friday to discuss how to "intensify popular struggles".The 11th International Meeting of the Communist and Workers Parties is jointly hosted by the Communist Party of India-Marxist (CPI-M) and the Communist Party of India (CPI).Among those attending the gathering are Oscar Martinez Cordoves of Cuba, Scott Marshll of the US, Manzurul Ahsan Khan of Bangladesh and Ai Ping of China.CPI-M politburo member Sitaram Yechury spoke on the occasion. General secretaries Prakash Karat (CPI-M) and A.B. Bardhan (CPI) were present. Meanwhile, Emphasising the threat of civil war in Afghanistan if the US withdrew its forces, Prime Minister Manmohan Singh has warned of 'catastrophic consequences for the world, particularly for South Asia' if the Taliban triumphed.The Supreme Court Friday dismissed a plea to ban idol immersions in water bodies across the country, saying restrictions would militate against the fundamental right of a section of citizens to profess and practice the religion of their choice.Suggesting a trade-off between the western world's demand for opening of trade in farm and industrial products and the developing countries' demand on labour migration towards concluding a global agreement under the World Trade Organisation, an industry chamber today said this and other measures could help India plan for an ambitious target of 300 billion dollar export by 2014.

Major financial sector bills such as the Insurance Law Amendment Bill seeking to increase the FDI cap in private insurance firms and the Banking Regulation Amendment Bill to raise the voting rights of foreign entities in private sector banks are unlikely to be taken up in the Winter session of Parliament that begins tomorrow.

However, the Constitutional Amendment Bill seek to roll out Goods and Services Tax (GST) and the Direct Taxes Code Bill may be tabled in the session that ends on December 21. The government will reintroduce the Pension Reforms Bill which seeks to give statutory powers to the interim sectoral regulator PFRDA and open up the sector, Parliamentary Affairs Minister PK Bansal told.

He said the Banking Regulation Amendment Bill and the Insurance Law Amendment Bill are unlikely to come up for consideration in the Winter session as they are still with the respective standing committees. However, a Constitution amendment Bill is likely to be presented for launching GST that will replace most indirect taxes at Center and states level, sources said. The Bill seeks to empower the Centre to tax goods beyond the stage of manufacturing. At present, this is entrusted with states. The legislation will also empower states to tax services. The Empowered Committee of State Finance Ministers has already come out with a discussion paper on the broad contours of GST which is scheduled to be implemented from the next fiscal.

Sources also said a separate Bill would be presented to replace the archaic Income Tax Act with the Direct Taxes Code. The Direct Taxes Code will replace Income Tax Act of 1961, but its draft has evoked sharp reaction for certain provisions like taxing withdrawals from long-term savings and minimum alternate tax. Finance Minister Pranab Mukherjee has assured a Parliamentary panel that concerns raised by corporates and other tax payers will be addressed before any further steps are taken on the Direct Taxes Code.

The Fair and Remunerative Price (FRP) for sugar was fixed at Rupees 129 a quintal for 2009-10 season, working out 44 per cent higher than cost of production of sugarcane, including the cost of transportation to the millgate, the Rajya Sabha was informed today.Mind you, Bowing to angry protests from opposition parties and farmers, the government Friday agreed to restore the earlier sugarcane prices.Ahead of his landmark visit to the United States, the Prime Minister, Manmohan Singh, has asserted that India wants the US to use all of its influence with Pakistan to stop it from sponsoring terrorism.Moving beyond the transformational nuclear deal, India and the US are set to unveil a new template for deepening strategic partnership on key global challenges, ranging from counter-terrorism to non-proliferation and climate change, when Prime Minister Manmohan Singh meets US President Barack Obama in Washington Tuesday.Gold zoomed to a fresh record high of Rs 17,295 per ten gm after gaining Rs 105 per ten gm today on the Bullion market on brisk demand from stockists along with encouraging global advice, traders at the Bombay Bullion Association (BBA) said.

The Sensex of Bombay Stock Exchange (BSE) today ended at 17,021.85 with a smart recovery of 236.20 points, as against its overnight finish at 16,785.65 points.

Ironically, Indian Political Parties including the Communists and Marxists do Ensure how to KILL the Popular Struggles!A day after the capital's heart was vandalised by over 40,000 protesting sugarcane farmers, police Friday said they could only do so much to prevent the situation from spinning out of control. For the first time in Madhya Pradesh, a clutch of children released the Unicef State of the World Children Report 2009 here Friday, praising the efforts of the government for their survival, care and protection but also calling for more focus.Children like Pappi Khan, Madhu, Aashi, Shivani Sen, Aarti, and Sunil - from Bhopal and Hoshangabad - were delighted to get a platform to speak out. They called on the state and society to speak out against female foeticide, child abuse and provide quality education and care to all children.Poor monsoon in the country led to the fall in agricultural production in the Kharif season this year to 96.63 million tonnes compared to 117.70 million tonnes in 2008-09, the Rajya Sabha was informed today.

"What's needed is a supportive environment that respects women's rights. Educating women and girls is pivotal to creating such an environment," said one of the children.

"Most of all, saving women and children's lives requires the concerted efforts of government leaders, health specialists, civil society, communities and families", said another.

"There has been considerable progress since the Convention on the Rights of the Child was opened for signature nearly 20 years ago though the rights of millions of children are still not respected or protected," said Manish Mathur, officer in charge of Unicef.

Twenty years after the UN adopted the treaty guaranteeing children's rights, fewer youngsters are dying and more are going to school, says Unicef's report.

Don't be surprised if your bank vanishes overnight to re-emerge with a new name.meanwhile, in a bid to check proliferation of counterfeit currency notes and make bank notes last longer, India's central bank will introduce 100 crore polymer notes of Rs.10 denomination on a trial basis soon, it said Friday.

Parliament Session begins with SUBVERSION with excellent Floofr adjustment of Ruling calss Political Parties belonging to NDA, Left and UPA. It heralds DISASTER and NEVER mind the Concern and commitment showcased to arouse Nationalism, Ethnonationalism and Sugar cane famrmers cause Upheld together.It is going to prove an illusion.The month-long winter session of parliament begins this Thursday, presenting the government with an opportunity to further its reform agenda. There has been much talk of reforms in higher educationand judiciary and second generation reforms in the financial sector. The government would need to introduce bills to address these issues.Meanwhile, Some 3,000 Indians, mostly in Jammu and Kashmir, have been killed in landmine explosions over the past 10 years, according to an NGO working for a world free of antipersonnel landmines and cluster munitions.On the other hand, With less than a week to go before the first anniversary of the 26/11 Mumbai terror attack, Defence Minister A.K. Antony reviewed the security scenario in the country in a high level meeting here on Friday.

Our maoist Friends are angry with me as I challenged their strategy to defend the Corporate and MNC interest in Got Up games with ruling Hegemony. They have written letters to Samayantar and raised the issue on different forum.I have got a letter from rajasthan which alleges that I stand to defend the Revisionist Marxists. Latest Maoist action to blow up a passenger train itself justifies that the Maoist leadership is not at all CONERNED with the Masses as it tries DIE Hard to showcase. It is as projected as any NGO. Let me see that the Maoists strike against Corporate and MNC nterest anywhere in those Maoist Frontiers captured by Corporates. Economic Times has published a story today, BRAND Final and analysed that the companies which focused on Local marketing, have gained more. RIL leading. It proves that Rural strategic marketing has paid DVIVIDENTS most and Maoists Never did try to stop this MOW menace. The Richest Peasantry based state remains Haryana, where no less than One Hundred SEZ have been proposed. One Crore Strength Kisan Sabha is silent. Vidarbha crisis is subverted by False Ethnonationalism called Maratha Manush.While Shetkari kamgar Union leader sharad Joshi has joined shivsena.

"In the last 10 years, around 3,000 Indians died due to landmines and over 2,000 were injured. Most casualties occurred in Jammu and Kashmir, followed by Manipur," according to Landmine Monitor Report 2009, which will be released Saturday.

Among the Indian states affected by landmines are Rajasthan, Punjab, Sikkim and areas affected by Maoist insurgency.

Landmine Monitor is the research and monitoring programme of the Nobel Peace Prize-winning International Campaign to Ban Landmines (ICBL).

Urging the government to sign the disarmament Mine Ban Treaty, the ICBL said India's antipersonnel stockpile is estimated to be between four and five million - the fifth largest in the world.

It said India's last major use of antipersonnel mines took place between December 2001 and July 2002, when the Indian Army deployed an estimated two million mines along its 2,880 km northern and western border with Pakistan during Operation Parakram. The operation directly affected more than 6,000 families across 21 villages in India.

Indian Army units have sustained heavy casualties in the course of demining operations, notably since the start of mine-laying on the Pakistan border in December 2001, the report said.

Some 39 countries, including India, China, Pakistan, Russia, and the US, have not signed the treaty.

According to Binalakshmi Nepram of Control Arms Foundation of India, the global use, production, and trade of antipersonnel mines have dramatically reduced and casualties have declined.

"But serious challenges still remain, with more than 70 states still mine-affected today," she said.

Major Barve from Mumbai confiremd that the Demonstration against SEZ led by Woman is all set to put Mumbai on standstill on 22nd November, But Medha Patkar has ultimaely planned to protest against SEZ on 25 , 26 Novemeber while Navi Mumbai is given away with the false movement.The Government Employees are sleeping and Twenty percent disinvestment targeted in 1009 itself in all profitable PSUs would not awakent them. They still depend on Marxist led trade Unions.On the other hand, The Congress is campaigning hard in Jharkhand for the coming assembly polls, with party chief Sonia Gandhi addressing two rallies in the state Friday and party general secretary Rahul Gandhi set to address four meetings Saturday.

The Supreme Court Friday suspended a Madhya Pradesh High Court order directing the state government to give land to the adult children of those displaced by the Indira Sagar dam project on Narmada river.Blood tests to detect diabetes are likely to be made compulsory at health centres across India following the internationally followed "opportunistic screening" norm. The scheme was in its pilot stage in 10 states, Health Minister Ghulam Nabi Azad said Friday.The central government has committed Rs.332.92 crore in various health measures to check the spread of Influenza A (H1N1), more commonly known as swine flu, Health Minister Ghulam Nabi Azad said Friday.The health ministry will spend Rs.9.2 billion this financial year for promoting Ayurveda, Yoga & Naturopathy, Unani, Siddha and Homoeopathy (AYUSH) - the Indian systems of medicine - in the country, Minister of State for Health S. Gandhiselvan told parliament Friday.

This morning APDR Activist and leader Dr Manas Joardar called me and we had a good chat. Dr, Joardar informed me that BANDI Mukti committee would have a meeting i HB Town this Eevning. I had to miss as I had prior engagement. But we discussed the Issues raised by Kabir Suman and he agreed that the issues are genuine.

I aske him if we Oppose the Economic reforms, Monopolistic aggression and Chidambaram`s war against the masses , why should we tag us with the Ruling Hegemony as it is quite Clear that the marxist would not Return to Writers in 2011 ? Why do we support Dr. manmohan singh and his Mass destruction Agenda supporting Mamata Banerjee, the scond partner in UPA?

He calrified that only a faction of the Intelligentsia and civil Society support Mamata!

But other are SILENT and waiting for Oppotune tie to respond suitably. I said,` Civil Society and Intelligentsia are replicating the World bank agenda only and represent the Market Dominating communities in the Free Market democracy!

DR Joardar agreed to discus it some time!

This morning, I woke up with the news breaking that the seniomost person in my locality, Chitya Guha was dead. I had to join the Funeral party. I just informed my young IT Wizard Son Tusu and requested him to let me sit on the PC as I had to write on Palestine and I would not get time later.

`So What if the Old man has departed,' he asked.

I smiled and said,` When your parents would die, the Neighbourhood may respond the Ditto'.

`Then?'He asked.

His mother also tried to convince that provided we are detached with the neighbourhood, who would come out to help us when we would need most!'

Tusu, I don`t know whether he was convinced but he allowed me to sit and work on the PC.

I see similarity striking in the behaviour of the Govyt. employees as they would never respond untiil they smeel some benefit. They are not INFORMED, Not Concerned. Their daily job is regular harrasment for the public. Recntly, a young Businessman did kill four Bank employees just indulging in REVENGE!

Thus, Don't be surprised if your bank vanishes overnight to re-emerge with a new name.And mind you it is delayed action as tyhe bank rec gulation bill is pending.The government should sell off half its public sector undertakings and use the 200 billion dollars it will thus make to build environmental assets, 13th Finance Commission Chairman Vijay Kelkar said here Friday.The finance ministry thus wanted right in 2004 that the country's nationalised banks to develop better brand equity, and become stronger and smarter.The ministry believed and has not chaged the strategy even after FIVE years that the merger of existing nationalised banks that will create a stronger identity can help win the confidence of depositors more than any of the mushrooming private banks.

"India built physical assets by setting up public sector undertakings when that was needed. Now private firms are able and willing to buy these assets. But they are not willing to build natural resource assets, which is what India needs now. That is what the government should build," the noted economist said.

Kelkar was speaking at the release of a report by the think tank The Energy and Resources Institute (TERI) on what India should look like in 2047, a hundred years after independence.

With just about a month left before the 13th Finance Commission submits its report, Kelkar said there were three inter-state issues "where we need to shift from negative to positive externalities through transfers -- forests, green energy and water". Externalities are the unintended consequences of an action.

Releasing the report, Environment Minister Jairam Ramesh predicted that by 2015, India would include environmental resources in its economic accounting and planning.

While commending TERI for providing a blueprint

for India's growth without damaging the environment, Ramesh pointed out that the country had excellent laws to protect nature, but they were not being implemented.

"Environmental governance is the key," the minister said, pointing to his plans to start a national environment protection authority and a national green tribunal as steps in this direction.

Presenting the highlights of the report, TERI Director General Rajendra K. Pachauri said land and water constraints would impede India's growth unless these issues were addressed and the question of social justice was addressed.

Pachauri also spoke of the need for states and local governments to take over environmental governance. "We need this," he said, "but efforts at decentralisation first need to address issues of capacity and accountability".

While addressing the urgent need to add to natural assets such as water, land or forests, Pachauri sought "renewed emphasis on efficiency and equity" in the use of these resources. The report also had concrete proposals on how to build India while taking care of biodiversity, minimising air pollution, handling municipal solid waste and so on.

Already there was talk of a possible merger of the Bank of India and the Union Bank of India . If it goes through it will create the second largest bank in India after the State Bank of India

But the Left dominated Trade Unions sat IDLE for FIVE years and have not responded as yet.

However, to merge the banks need the approval of their respective boards of directors and the final nod from the Reserve Bank of India, it was the original plan which may be modified.

The government has indicated some items on its legislative agenda. The Equal Opportunities Bill was recommended by the Sachar Commission to enforce affirmative action -- in both the public and private sectors. The law minister has indicated that he may introduce bills to codify accountability of judges and declaration of their assets and take measures to improve delivery of justice.

The human resource development minister has also indicated the possibility of legislation to reform the higher education sector, including a new regulatory structure and permission for foreign universities.

The government will introduce bills to replace four ordinances that have been promulgated since the last session. The Essential Commodities Act was amended to provide that the price fixed by the central government for sugarcane shall be taken into account while calculating the price paid to sugar mills for levy sugar. This has become a controversial issue as the minimum sugarcane price fixed by state governments is often significantly higher than the central government pricing.

The Central Universities Act was amended to bifurcate the Jammu and Kashmir University. The Competition Act was amended for immediate closure of the MRTPC; earlier a two-year time frame was fixed for the purpose. And the Jharkhand Contingency Fund (with the state being under President's rule) was enhanced from Rs.150 crore to Rs.500 crore. It is likely that the last three bills will be passed with broad agreement from most parties.

Thirty-six bills are pending in the Rajya Sabha from earlier sessions. These include the seeds bill, the communal violence bill, the women's reservation bill and amendments to the insurance act.

Some of these bills have not been taken up for discussion as they face strong opposition from some political parties. For example, the seeds bill that regulates the manufacture, distribution and sale of seeds also requires inter-farmer sale of seeds to conform to quality tests and norms. The standing committee has recommended deletion of this requirement; it will be interesting to see whether the government proposes any amendments.

The communal violence bill doubles the punishment for certain crimes if they are committed as part of communal riots. This has been criticised as ineffective on account of the low conviction rate in such cases.

The women's reservation bill has been referred again to the standing committee, as the earlier committee was not able to arrive at a consensus.

The insurance bill raises the foreign investment limit to 49 percent (currently 26 percent) and allows nationalised general insurance companies to raise funds from the capital markets. This bill is pending with the standing committee, and could see opposition from the Left parties.

Some of the bills that lapsed with the dissolution of the last Lok Sabha could be re-introduced. The president's address in June signalled urgency over the land acquisition amendment and the rehabilitation bills. However, some cabinet ministers have reportedly objected to these bills.

The bill to amend the Forward Contracts Regulation Act was stalled last year due to opposition from the Left. Given the current position of the UPA government, this bill could be revived. The case of the pension regulatory bill is similar; indeed this bill has been publicly supported by the Bharatiya Janata Party.

A set of bills could be introduced related to the State Bank of India (SBI) group -- reducing the minimum government shareholding in SBI to 51 percent (from 55 percent), merger of the State Bank of Saurashtra into SBI, and transfer of some powers regarding these banks from the Reserve Bank of India to the central government.

Of the bills introduced last session, 10 are pending. The Rubber Amendment Bill was taken up on the last day of the last session but was not discussed as the opposition objected to the absence of the ministers concerned. This bill delicenses planting and replanting of rubber, amends the powers of the Rubber Board, and enables the revocation and refund of excise on rubber manufactured for export between 1961 and 2003.

The Land Ports Authority Bill establishes an authority for managing the movement of people and goods across land borders; the bill is being scrutinised by the standing committee. The workmen's compensation amendment enhances the amount of compensation to be paid in case of death or permanent disability.

The UPA-I government was unable to conclude several of its legislative initiatives. The president's address as well as subsequent announcements by various ministers indicate the resolve to carry forward much of that agenda. It would be interesting to see to what extent the government succeeds in this regard during the winter session.

The finance ministry had already forwarded the merger plan to the RBI for its approval in 2004 which is to be IMPLEMENTED once the Parliament passes the Bill.

As both were leading banks, discussions was focused on what name the new 'merged identity' should have. The Bank of India was insisting on retaining its brand name on the ground that it was bigger in terms of assets, net worth and profits. The Union Bank of India, meanwhile, pointed out that it had higher market capitalization -- Rs 4,279 crore (Rs 42.79 billion) as against BoI's Rs 3,438 crore (Rs 34.38 billion).

Reportedly, Andhra Bank [ Get Quote ], Indian Bank [ Get Quote ] and Vijaya Bank [ Get Quote ] constitute the other lot of the nationalised banks that had informed the government about their intent to merge and form the leading bank in the southern states.

Together, they would have a spread of 3,400 branches across the country, majority of them in the southern region.

Canara Bank [ Get Quote ] and United Commercial Bank too were learnt to have sent proposals to the finance ministry for their merger, while Indian Overseas Bank [ Get Quote ] with Punjab National Bank [ Get Quote ] too were considering the possibility of a merger.

Way back on 10th september, 2004, then Finance minister P Chidambaram, had said that the government would encourage consolidation within public sector banks and would help bring about a favourable legislative framework that would facilitate mergers.

However, he said that the decision on the actual process of mergers would be left to the boards of the banks. "We are not going to push for consolidation. However, if banks want to consolidate we will not come in the way," Chidambaram said after a meeting with chief executives of public sector banks.

He said that legal amendments, including minor ones required in the Income-Tax Act, would be brought about to remove any hurdles in consolidation. "We need a small amendment in the I-T Act which would be carried out in February next," Chidambaram said.

Chidambaram also said that the government would encourage banks to raise further capital by way of public issues. "I have encouraged them to go to the capital market," he said.

On the interest rate movement, Chidambaram said that he expected stability in interest rates in the medium term. "In the medium term, interest rates are expected to be stable. That is my assessment," he said. The finance minister said that there was excess liquidity in the market and banks would be encouraged to lend.

Bank staff against merger of nationalised banks

Staff Reporter

TUTICORIN: Bank employees will resort to agitations in short notices, if the centre decides to implement merger of various nationalised banks with the objective of going `global', C.H. Venkatachalam, General Secretary, All India Bank Employees Association, has said.

Speaking to media persons here, he said the merger of banks would not strengthen the financial institutions' pursuit to enter the global trade and fight the multinational banks as envisaged by the Finance Minister, P. Chidambaram, but rather it would have a cascading effect on domestic development in the long run.

The Finance Ministry should understand that nationalised banks were formed not for venturing into global competitions, but aimed at catering to the needs of the public, especially rural masses, he said.

Mr. Venkatachalam said the Centre should not go ahead with its decision to sell 49 per cent of shares in the nationalised banks to private parties, as it could lead to the dilution of objectives of nationalisation of banks.

So far, only the nationalised banks were found to have been involved in priority sector lending and poverty alleviation, complying with RBI norms, and hence any move to disinvest the shares further would turn the `mass' banking concept into `class' banking concept, thus, benefiting only a certain class of the society, he said.

On Foreign Direct Investment in private banking sector, he said if 74 per cent of FDI was allowed in the private financial institutions, foreign players would have a final say in the daily activities of banks much against the interests of the nation.

Mr. Venkatachalam said bank employees across the country would observe a one-day strike on September 29 to protest "anti-labour and anti-public" sector undertakings' policies of the Centre.

http://www.hindu.com/2005/09/03/stories/2005090302020300.htm

Merger of banks opposed

By Our Staff Correspondent

MANGALORE, AUG. 22. The All India Bank Officers' Confederation (AIBOC) opposes any proposal for the merger and amalgamation of nationalised banks, a move first mooted by the Narasimhmam Committee, the Joint General Secretary of the confederation, T.R. Bhat, has said.

Addressing presspersons here on Sunday, Mr. Bhat said there were 19 nationalised banks and eight under the control of the State Bank of India. These banks were functioning efficiently and there was no need to merge them with others.

Noting that the Union Government was thinking on these lines, he said the Indian Banks' Association had formed a sub-committee for the purpose. The move to merge and amalgamate banks could be welcomed if it promoted efficiency as was expected by planners. But the previous experience on such moves had not yielded the desired results even in the West, he added.

http://www.hindu.com/2004/08/23/stories/2004082302650500.htm

Strategic buyouts in banks imminent

March 11, 2004

A few months ago, banking secretary N S Sisodia held a high-level meeting with a few public sector bank CEOs in Jaipur. At the meeting, the CEOs were asked to offer their views on consolidation in Indian banking.

But with routine topics -- priority sector lending and kisan credit cards -- dominating the discussions, no chairman really touched on the issue seriously. Besides, most of them felt that should the mergers & acquisitions (M&A) scene hot up, they could only be the acquirers.

What Sisodia could not do, the finance ministry notification -- giving foreign banks the green signal to increase their presence in India -- has successfully done. They are crawling out of the cocoon of complacency and taking a hard look at their balance sheets.

The ministry has permitted foreign banks to set up 100 per cent subsidiaries in India and allowed them to acquire up to 74 per cent equity in existing private banks.

Theoretically, only the private banks should feel threatened. But the public sector banks seem to be more concerned because they feel the seeds for a shakeout are being sown and the state-run banking industry will not be left out of the consolidation drive.

In fact, the chiefs of some of public sector banks that are relatively small and do not have a national presence are eagerly looking forward to the shakeout. Says one such CEO: "Everything is possible. I can be an acquirer or be acquired. One thing is for sure, the industry cannot escape consolidation."

Until recently, this bank chief used to be answerable only to the government, and whenever there was a crisis, he knew that he could get fresh capital to wipe off the red from his balance sheet. Now, lakhs of investors, analysts and foreign institutional investors, besides the government (which still holds a substantial chunk in his bank), scrutinise his performance while his eyes constantly follow the price movement of his bank's stock on the bourses.

In the recent past, Punjab National Bank took over private sector Nedungadi Bank. It is now in the process of acquiring IFCI, too. But both these cases were forced mergers, a rescue operation initiated by the government.

Bank of Baroda's acquisition of Benaras State Bank two years ago and a local area bank in south Gujarat now fall in the same category. But the next round of M&As in banking will have a different dimension. The guiding principal will be strategic importance.

State Bank of India is set to kick off the trend by buying out the government's stake in the Infrastructure Development Finance Corporation and converting it into an SBI subsidiary.

The next player could be the Industrial Development Bank of India, although nobody has a clear idea about the government's plan for IDBI.

Last year, the finance ministry bounced the idea of merging IDBI with SBI but did not get a positive response from the bank management. Now, it may revive the plan. Alternatively, one or more banks may be merged with IDBI.

Industrial Investment Bank of India, a puny, Kolkata-based financial institution, is also up for grabs. It can be merged with IDBI or even gobbled up by a local bank.

Once the repositioning of the three institutions -- IDBI, IDFC and IIBI -- is taken care of, the real M&A game will see some of the big players like SBI, PNB, Bank of Baroda, Bank of India and Canara Bank getting bigger, and relatively small public sector banks that are still regional players being merged with others.

The seven associate banks of SBI can also play a big role in this game. At the moment, there are 19 nationalised banks, besides the SBI and its seven associate banks, taking the number of state-run banks to 27. An internal finance ministry study, which has not been made public, is believed to have envisaged a smaller pack with a pan-Indian presence.

It has even asked the Reserve Bank of India to set up a committee to look closely at the consolidation issue. Overall, the number of scheduled commercial banks is bound to shrink as some of the private sector banks will be taken over by foreign players.

To ensure a smooth passage to the new zone, the government needs to amend the Banking Regulation Act and drop its stake below 51 per cent, which was proposed a few years ago but has not occurred owing to political compulsions. It also needs to take a relook at the norms that govern M&As in the banking sector.

Currently, the merger of two nationalised banks is governed by the Banks Companies (Acquisition & Transfer of Undertaking) Act, 1970, which calls for submitting the scheme of merger to both houses of Parliament. This procedure was followed when New Bank of India was merged with PNB -- the only instance of merger of two nationalised banks.

In the case of private banks, the M&A rules are laid down in the Banking Regulation Act, where the scheme of amalgamation is approved by the RBI. If a listed entity is involved in the deal, the scheme also needs court and shareholder approval. There are no rules for the merger of a bank with a non-banking entity.

Once the regulatory issues are in place, some Indian banks could also emulate the examples of Reliance Infocomm and Tata Motors, and look for overseas acquisitions.

In fact, over the past year, some big banks (big, that is, in the Indian context) have been aggressively focussing on their overseas operations. SBI now has 48 overseas offices spread over 28 countries covering all the time zones.

Last year, SBI closed its Jakarta and Sao Paulo representative offices as part of an exercise to restructure its representative office network, but upgraded its representative office in Moscow.

It is in the process of upgrading the Sydney and Shanghai representative offices to full-fledged branches and opening branches in Chittagong in Bangladesh and Cape Town and Port Elizabeth in South Africa.

SBI also has two wholly-owned subsidiaries (SBI Canada and SBI California), two subsidiaries (Indo-Nigerian Merchant Bank Ltd and SBI International Mauritius Ltd) and two joint ventures (Nepal SBI Bank Ltd and Bank of Bhutan).

Bank of Baroda is present in 16 countries with 61 offices, besides a subsidiary in Tanzania and a representative office in China. It has six subsidiaries in the UK, Hong Kong, Guyana, Botswana, Uganda and Kenya and an associate in Lusaka -- Indo-Zambia Bank Ltd.

Bank of India has 18 branches and three representative offices spread across four continents with presence in all major financial centres -- London, New York, Paris, Tokyo, Singapore and Hong Kong. Last year, it opened two new representative offices at Shenzhen (China) and Ho Chi Minh City (Vietnam). It has two subsidiaries and one associate outfit in Hong Kong, where it also manages a deposit-taking company.

At least some of these banks do not have any capital constraint for acquisitions. They are believed to be seriously exploring options abroad.

The obstacle is World Trade Organisation norms, which do not allow them to pick up any financial player in any country unless they have the most favoured nation (MFN) status. This forbids any acquisition bid in neighbouring countries like Sri Lanka.

However, they can set their eyes on some of the para-banking outfits in the United States or building societies in the United Kingdom. Some banks are actually looking at these possibilities to prop up their foreign operations, which at present do not account for more than 20 per cent of total business for any Indian bank.

The sooner that happens, the better. Let the local banks join hands with the manufacturing sector to take the India story abroad.

Powered by Business Standard

Condemn Maoist violence, government tells civil society

A day after a passenger was killed and 40 others were injured in a train derailment after Maoist guerrillas blew up a track in Jharkhand, the government Friday asked the civil society to condemn such 'wanton acts of violence' meant to sabotage polls in the state.

Since the Jharkhand stater assembly elections were announced, the Communist Party of India (CPI)-Maoist has unleashed a reign of terror in the state by "killing innocent persons and labelling them as informers" and targeting public properties, the union home ministry said.

"They (the rebels) seem determined to carry out the threat to disrupt the polls," a statement from the ministry said.

The five-phase state assembly polls in Jharkhand begin Nov 25.

The home ministry "thinks that civil society organisations should also play their part and condemn the wanton acts of violence and ask the CPI-Maoist not to disrupt elections".

Three school buildings were damaged in Latehar district in separate acts of violence Nov 6 and 10, the ministry said, adding an under-construction Panchayat Bhavan was blasted in West Singhbhum Nov 15.

"The CPI-Maoist exploded a bomb on a railway track between Manoharpur and Pusaita railway stations (Thursday); two bogies were blown up and six derailed. One passenger was killed and 40 were injured," the statement said.

It said the rebels "have also issued a call to the people to boycott the elections".

"The government condemns these acts of violence. The Jharkhand government will continue to take pre-emptive action against the CPI-Maoist in order to maintain law and order and to facilitate free and fair elections," it added.

| | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Banking reforms: more threat than promise

Sucheta Dalal

Posted online: Jan 03, 2005 at 0000 hrs

When the search committee to select the next chairman for the capital market watchdog met last week, people were surprised that M Damodaran was one of the names on the shortlist of five. The question is; why would Mr Damodaran be considered for another job when he has just taken on a fairly gigantic one of turning around IDBI? The answer probably lies in the fact that a turnaround in the nationalised banking sector is rather more difficult than working magic at India's largest mutual fund.

Public sector bank chairmen are forced to operate within the framework of conflicting pulls and pressures from the finance ministry and RBI, and suffer their slow decisionmaking and interference—all this at salaries that are a fraction of those earned by senior executives in private banks.

Consider this. For the last five months, the government has frequently repeated its resolve to permit 74% foreign direct investment (FDI) in private banks. Yet, the RBI hasn't budged from its draft guidelines that say—no single entity (unless it is widely held) can hold more than 10% of the equity of a private bank. Yet, the RBI itself had shown no consistency in its past clearances of FDI in private banks.

Similarly, the government's avowed support for consolidation and merger of nationalised banks caused a flutter in the stockmarket, but has made little progress on the ground. So far, Bank of Baroda is wooing Dena Bank and Bank of India has announced an alliance with Union Bank of India. State Bank of India and IDBI have declared that they are seeking interesting partners.

These announcements caused the BSE bank index (Bankex) to shoot up 31% in six weeks from 2,660 on October 15 to 3,495 on December 9. It rose another 8% after a small lull to 3,722 on December 31. This is merely based on speculation and hope. There are far too many structural issues that need to be addressed before banks can truly turn into attractive investments.

| • Govt's resolve on FDI in banking conflicts with RBI's draft guidelines • Govt claims to support consolidation but is reluctant to give autonomy • Reform in 2005 must give aim at giving more space to nationalised banks |

The government's belated action to ensure the continuance of PJ Nayak as chairman and managing director was welcome. But there is still no clarity over whether government entities want to hang on to a majority stake in UTI Bank or are willing to let it go.

If they choose the latter, then an exit strategy must be decided before government holding is diluted further, in order to get the best price for UTI-I's shareholding. Already Hongkong Bank (HSBC) and Barclays are waiting in the wings with a 15 and 5% stake respectively. A slow consolidation of their holdings will kill the prospect of competitive bidding and lead to a lower realisation for UTI-I if it chooses to sell out.

There is similar confusion about PSU bank mergers. On the one hand, the government claims to support consolidation, and has allowed all banks to be publicly listed; but it refuses to allow even basic operational autonomy to nationalised banks. The finance ministry insists on banks seeking specific approval of simple decisions such as raising fresh capital, declaration of dividends and branch expansion, inspite of having a representative on the board who acts like a super-chairman.

Banking reform in 2005 must aim at giving up this obsessive control and unshackling nationalised banks, giving them procedural autonomy and allowing them the space to be more competitive through quick decisionmaking.

Mr Damodaran, who has worked in the finance ministry, the RBI and is now a bank chairman had a clear and succinct list of reforms that are necessary to for PSU banks to be in a position to compete equally with foreign banks. It is only fair that these reforms are in place before the government exposes the banking sector to foreign competition by permitting 74% FDI and removing the cap on voting right. Mr Damodaran's prescriptions are as follows:

o Structural issues cannot be add-ressed incrementally and the country will be better served by setting up a banking commission. The commission will discuss issues through wide consultations and adopt a more holistic approach to reform, instead of allowing banks to be buffeted between the finance ministry and RBI. This is long overdue.

o The government must make a distinction between regulation and control by formalising its intervention in the working of nationalised banks. As the majority shareholder, it does have the right to decide broad policy issues and direction, but this must be conveyed through its nominee on the board of directors rather than a series of directives issued to the chairman. The board comprises eminent people from different disciplines who bring in diverse skills and knowledge. A board discussion may refine an idea and find better ways of implementing the government's decision rather than a unilateral directive to the chairman.

o As a corollary, decisions such as declaration of dividend, raising fresh capital, or opening new branches should not require separate approval from the finance ministry, once it is okayed by the board.

o Identifying the right people for senior management functions, which provide appropriate leadership for specific banks. Instead of mechanically appointing bank chairmen and moving them from one bank to another, there has to be an effort to marry specific skills with the growth needs of each bank. For instance, one bank may need a chairman skilled in personnel management, while another may need a banking whiz to steer operations. It is important to choose correctly, rather than to adopt a lottery approach.